Alcoholic Drinks in Middle East and Africa

The alcoholic drinks market has made a swift recovery from the pandemic losses of 2020, returning to pre-COVID-19 sales levels already in 2022. In spite of the difficult economic situation, premiumisation continued to be seen in Nigeria, although it slowed in 2022. Higher-income consumers, the key consumers of premium products, tend to less impacted by difficult economic conditions. Another trend being seen in a number of countries is the ongoing popularisation of no-/low-alcohol products.

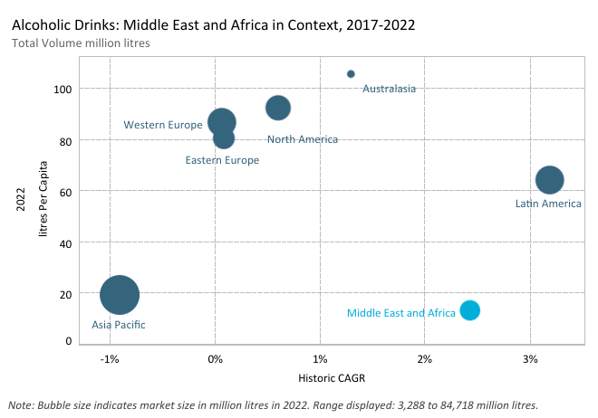

Middle East and Africa has the lowest per capita consumption rate for alcoholic drinks

Only Australasia has a lower sales level than Middle East and Africa for alcoholic drinks among the seven regions.

However, Middle East and Africa recorded the strongest sales growth in 2022 and is also expected to register the highest CAGR over the forecast period.

Middle East and Africa has the lowest per capita consumption rate among the regions.

Per capita consumption growth was flatlining in the region over the review period, with Middle East and Africa expected to record the fourth highest regional CAGR in 2022-2027.

Per capita rates in the region will continue to be relatively low, given a number of countries in the Middle East are Muslim majority, with drinking alcohol taboo.

Positive growth expected in Middle East and Africa throughout the forecast period

After seeing healthy growth rates prior to the pandemic, the impact of COVID-19 resulted in a marked decline in alcoholic drinks unit volume sales in Middle East and Africa in 2020.

Recovery began in 2021, which continued in 2022, with a return to pre-pandemic sales levels in this year.

Healthy annual growth rates are then expected from 2023 onwards, in spite of the difficult economic backdrop being experienced in many countries moving into the forecast period.

While off-trade sales returned to their pre-pandemic levels in 2021, this is not expected to happen for the on-trade until 2023.

The on-trade generally recorded worse performances than the off-trade when COVID-19 hit the region in 2020.

Spirits and wine play a much greater role in value than volume terms in alcoholic drinks

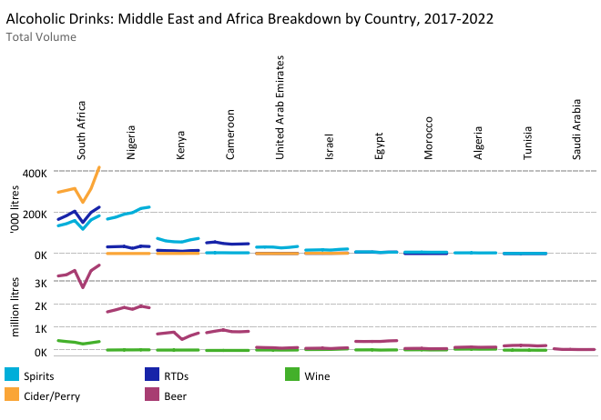

Beer accounted for 87% of alcoholic drinks unit volume sales in Middle East and Africa in 2022, with 5% being the biggest share held by any of the other main categories.

However, beer’s share drops to 53% of sales in real value terms, with spirits holding a 26% share and wine 17%.

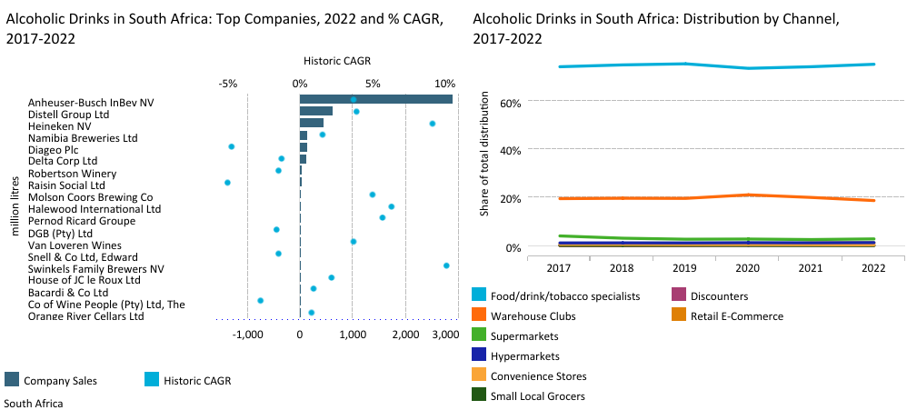

Cider/perry was the most dynamic of the main categories over the review period. South Africa dominates sales of cider/perry in Middle East and Africa.

Distell Group is the clear leader in South African cider/perry with its Savanna and Hunter’s brands.

Savanna has benefited from strong marketing through advertisements and sponsorships as well as its competitive price point, although premium cider brands like Kopparberg or Rekorderlig have also been seeing rising demand.

Strong recovery seen in South Africa in the final two years of the review period

South Africa had one of the deeper declines in its alcoholic drinks market in 2020 as the government banned sales of this product during lockdown in order to discourage gatherings.

This meant a particularly strong rebound in sales in 2021, followed by further strong growth in 2022.

New product developments in certain categories, such as RTDs or spirits, and gin in particular, have also helped boost sales in South Africa.

With alcoholic drinks prohibited under Islamic law in Saudi Arabia, sales remained dependent on non-alcoholic beer over the review period.

The economic fall-out of the pandemic has been limiting the strength of the recovery in sales of non-alcoholic beer in Saudi Arabia since 2020.

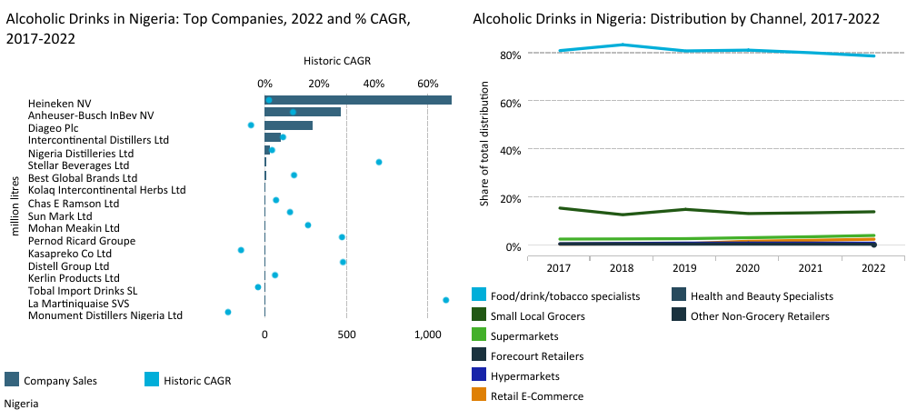

Strong growth for spirits in Nigeria over 2017-2022

Although alcoholic drinks as a whole declined in Nigeria in 2022, spirits continued to record positive growth.

Consumers were experiencing weaker spending power due to high inflation and the poor economy in Nigeria in 2022.

This saw beer decline as consumers sought cheaper alternatives in other categories, such as economy spirits, due to strong unit price increases.

In spite of the difficult economic backdrop, premiumisation also continues to be seen in alcoholic drinks in Nigeria.

Premiumisation is most obvious in spirits, in which super-premium brands such as Glenfiddich performed well in 2022.

When consumers could not afford premium brands, many switched to less expensive brands, eg from Hennessy cognac to Jameson Irish whiskey.

Off-trade outperformed the on-trade when the pandemic hit the region in 2020

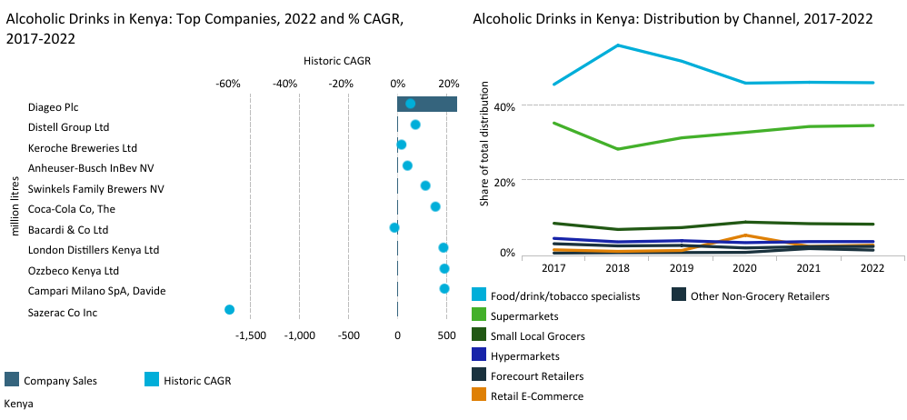

In Nigeria, Cameroon and Kenya, the on-trade has greater unit volume sales than the off-trade.

The on-trade generally suffered deep losses in alcoholic drinks sales in 2020 when COVID-19 first hit the region.

While the off-trade declined in most countries in this year as well, it generally performed better than the on-trade.

In a few countries, eg Egypt or Israel, off-trade sales even enjoyed a spike in demand in 2020, as people switched more of their consumption into their homes due to the COVID-19 restrictions.

Both of these countries already had particularly big off-trade shares prior to the pandemic.

However, the biggest off-trade share is in Saudi Arabia, with the lowest being seen in Cameroon.

Cider/perry the most dynamic product over 2017-2022

Food/drink/tobacco specialists the main distribution channel for alcoholic drinks

Retail e-commerce gains have slowed since its growth explosion in 2020

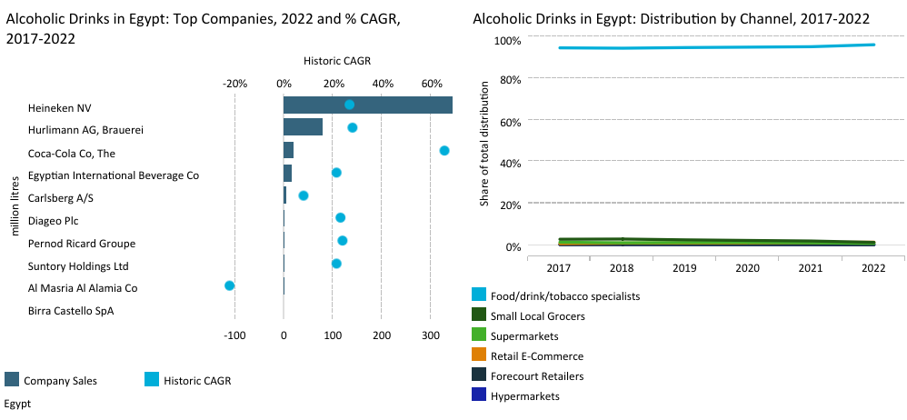

The main distribution channel for alcoholic drinks in Middle East and Africa is food/drink/tobacco specialists, which held a unit volume share of 68% of retail sales in 2022. Supermarkets follow, a long way back, on 10%, with small local grocers and warehouse clubs each holding 7% shares and hypermarkets 4%.

Although it recorded strong growth during the pandemic, retail e-commerce still only accounts for just over 1% of alcoholic drinks sales. In some markets, eg Algeria and Cameroon, there are no online sales at all. The biggest share for internet retailing is in Israel, at 14% in 2022, having reached almost 16% in 2020.

Food/drink/tobacco specialists account for more than three quarters of sales in the region’s biggest markets, South Africa and Nigeria, and more than 96% of sales in Algeria and Egypt.

While e-commerce grew in South Africa during the pandemic, food/drink/tobacco specialists still dominate sales. And the opening of four new shopping centres in less central areas of South Africa will also help to boost offline sales in the country.

Convenience and growth in the younger consumer group of legal drinking age is helping to drive a shift in retail distribution in Nigeria, which has traditionally been dominated by drinks specialists. While modern grocery retailers such as supermarkets continued to grow well in 2022, as they tend to stock a wide variety of alcoholic drinks products, small local grocers also increased its share in this year, as consumers increasingly preferred to shop closer to home due to the desire for convenience.

The younger adult population is also boosting sales through retail e-commerce, because they are more “tech savvy” and therefore more likely to use online channels than older consumers. However, although specialist online retailers gained a good share of retail distribution over the review period, many such specialists have focused on wholesaling rather than direct retail sales.

Supermarkets remain the main distribution channel for alcoholic drinks in Tunisia. Distribution of alcoholic drinks is under the control of the Trade Ministry and, in order to obtain distribution authorisation, the Trade Ministry must approve it with an Interior Ministry agreement.

Leading companies and brands

Heineken acquires Distell Group and Namibian Breweries

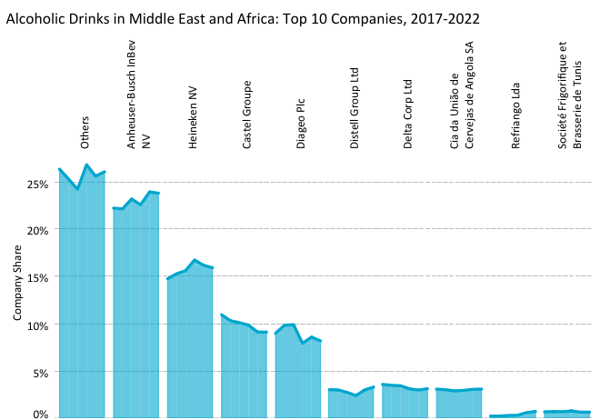

There is major concentration in the alcoholic drinks markets in a number of countries across the region.

The competitive landscape in South Africa will likely be seeing changes in the near future, with a stronger number two player emerging to put greater pressure on leading company AB InBev, which holds a 59% share of alcoholic drinks sales.

Heineken, in third position, has acquired second-placed Distell Group as well as fourth-placed Namibia Breweries.

Heineken now plans an investment programme of more than USD500 million in the new entity over the next five years, which will include the building of a new brewery and malthouse.

Heineken also plans to use the new entity to create an innovation and research and development hub for the overall region.

AB InBev maintains its lead in Middle East and Africa

Competition within RTDs strengthened in South Africa in 2022 as Coca-Cola and AB InBev launched new products.

Using pre-existing distribution channels to reach consumers, they each produced conveniently packaged beverages with low 5% ABVs, targeting the growing consumer group demanding low/no alcohol products.

AB InBev’s Black Crown (gin and tonic RTD) appeals to the gin trend, while Coca-Cola’s Topo Chico (vodka-based hard seltzer) is a gluten- and preservative-free RTD.

Heineken is increasingly focusing on diversifying into spirits in Nigeria. This is partly to offset its declining share in beer.

The contribution of spirits to its revenue increased from 16% in 2019 to 20% in 2022, while beer’s revenue contribution fell from 74% in 2019 to 65% in 2022.

AB InBev, Heineken and Diageo present across much of the region

The multinationals AB InBev, Heineken and Diageo have a presence in alcoholic drinks in many of the Middle East and Africa region’s markets.

Among the single-market players are Société Frigorifique et Brasserie de Tunis, which accounts for almost two thirds of sales in its home market of Tunisia.

Its home market accounts for all of Union Camerounaise de Brasseries’ sales, but it is only ranked fourth there, with Heineken leading the Cameroonian market, ahead of Castel Groupe, which generates more than half of its sales there.

Namibia Breweries, which has South Africa as its dominant market, is soon to be swallowed up by Heineken, while Nigeria dominates Intercontinental Distillers’ sales, despite it only having a relatively small share of the overall market.

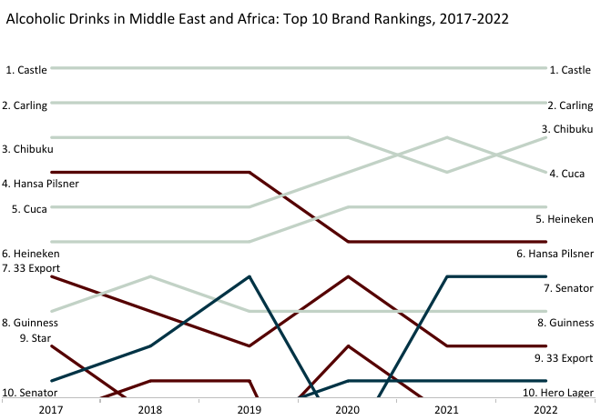

Kenyan beer brand Senator moves back up the rankings after its 2020 sales losses

Heineken’s Desperados brand has been seeing exceptionally strong growth in Nigeria, where it now dominates sales of flavoured/mixed lager, as it also does in Egypt.

The success of Desperados in flavoured/mixed lager persuaded AB InBev to launch Flying Fish in this category in Nigeria in 2022.

The up-and-down performance of Senator regionally in recent years can be explained by the fact that Kenya, its home market, where it leads beer, saw a particularly deep decline in 2020.

The Senator brand lost half of its sales in 2020, as the pandemic hit beer sales in Kenya, but it then, along with the market as a whole, recorded a very strong rebound in 2021, followed by further growth in 2022.

Forecast projections

Positive growth expected for alcoholic drinks throughout the forecast period

Nigeria expected to see strong growth over 2023-2027

Alcoholic drinks is expected to see strong growth in Nigeria over the forecast period, supported by a rapidly expanding population, urbanisation and improving economic conditions. The growth of the younger population of legal drinking age in particular will be a key determinant of the performance of various categories, as young adults increasingly seek novel and sophisticated products. This will help to drive success for more niche categories such as flavoured/mixed lager, cider/perry and wine.

Non-alcoholic drinks are expected to continue growing well in Nigeria. These are popular among people who do not consume alcohol, but want a drink that is more mature and less sweet than a soft drink. With much of the Nigerian population not regular alcohol consumers, non-alcoholic drinks categories are expected to grow robustly in line with both population and income growth.

South Africa is expected to see rising sales of alcoholic drinks over the forecast period. While drinks with a higher alcohol content will remain popular, over time, a shift is expected to emerge, slowly favouring products with a lower ABV. Non-alcoholic drinks have already expanded across alcoholic drinks. This has been driven by health consciousness, dubbed “sober-curiosity”, which is gaining ground among young people of legal drinking age, many of whom are seeking to moderate their alcohol consumption.

Alcoholic drinks players can expect South African consumers to remain value-conscious in their consumption behaviour. While consumers will still opt for products with a longer shelf life and look to trusted brands, new entrants will need to adopt similar attractive strategies, while maintaining the uniqueness of their own brands. E-commerce platforms will offer these new brands the opportunity to promote their products and gain consumer loyalty, before securing space on the shelves in bricks- and-mortar stores.

The alcoholic drinks market in Algeria is still relatively underdeveloped, with significantly larger volumes being generated by more traditional categories such as lager, still red wine, whiskies or vodka. The religious environment in what is a Muslim country and long-standing consumption habits tend to hold back the development of new categories such as dark beer, cider/perry or emerging innovative spirits products. However, the number of potentially open-minded alcoholic drinks consumers is constantly rising, which, combined with the increasing product variety, is gradually leading to rising consumer awareness, developing the culture of alcoholic drinks consumption.