Premiumisation in Spirits: Aspiration and Adversity

While premiumization has demonstrated remarkable resilience in spirits, the inevitable slowdown is now underway. Discretionary spending is being scaled back, as a result of prolonged cost of living pressures, and the effects will become increasingly pronounced. Nevertheless, trends are not changing course entirely; core drivers of premiumization are deeply embedded in demand, while moderation favors quality over quantity. How can brands enhance value in an unsettled world?

Key Findings:

Premiumisation is under pressure

Even as inflation eases (for now) in much of the world, cost of living pressures continue to drag on spirits consumption. Premiumization is slowing as the prolonged strain on household finances forces consumers to cut back on purchases, or even consider trading down. The relative affordability of retail prices means further moves towards at-home socializing will be a common story.

Building flexibility into strategies is ever more important

The developments underway represent a change of pace rather than a change of direction. Still, an adaptable approach to prices, products, and outreach efforts will help target short-term affordability needs, although discounting should be used sparingly to avoid undermining positioning. Global economic uncertainty and geopolitical tensions risk further disruption to supply chains and spending habits in the years ahead; flexibility needs to be kept in mind.

“Less but better” is still the foundation of spirits demand

Premiumisation is rooted in several embedded trends: the focus on quality over quantity linked to well-being concerns, aspirational consumption, and demand for authenticity and heritage. Those themes will outlast temporary disturbances. Concentrating on qualities known to enhance value, and responding effectively to developments and nuances between categories, will help businesses navigate uncertain times.

The changing nature of aspiration

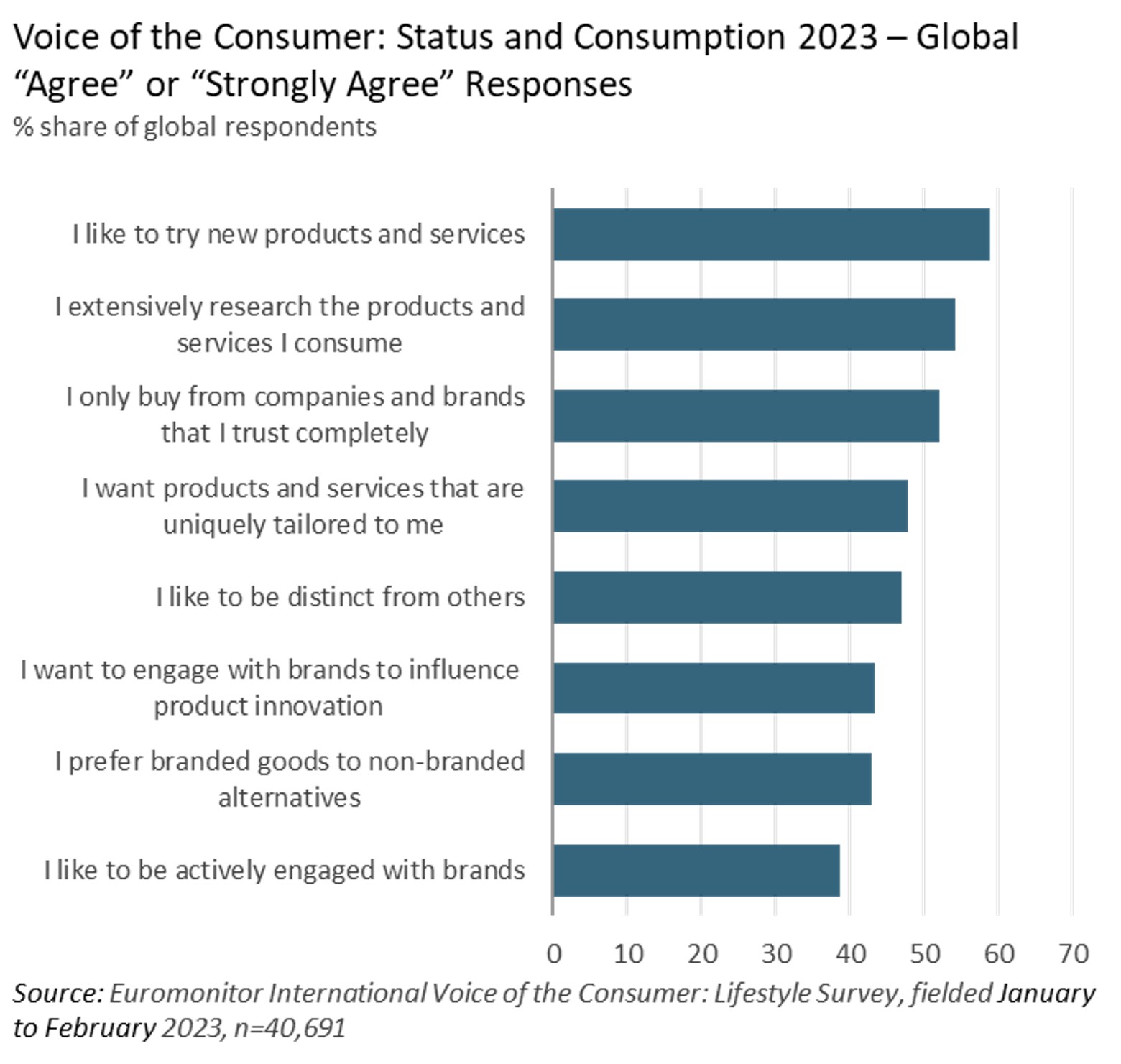

The meaning of “premium” is evolving as priorities are revised in an interconnected and unsettled world, and demographic shifts see Gen Z and Millennials gain influence. Ostentatious displays are out, and authentic messaging, environmental and social responsibility, and digital literacy are in. Socializing and creating memories are still considered vital, and imaginative experiences can tap into that demand to leave a lasting impression.

The situation as it stands

During the pandemic and the immediate aftermath, premiumization patterns in spirits became highly pronounced. Consumers first sought opportunities for indulgence, given limited outlets for discretionary spending, then upon reopening, pent-up demand fueled a boom in socializing.

Aspirational consumption, the search for authenticity, and moderation trends – driving consumption in lower volumes but focused on higher quality options – are entrenched in spirits demand.

However, signs of the seemingly inevitable slowdown in premiumization are already starting to appear. Consumers are not, and cannot, keep trading up in their purchase choices to the level seen in recent years. While that does not indicate trends are changing direction entirely, it is a noteworthy development, nonetheless.

At the same time, shifts in consumer demographics, priorities and expectations are redefining the nature of aspiration. How will premiumization unfold in an unsettled world, and how can the industry respond?

Premiumization: the backbone of spirits demand

Premiumization forms the foundation of many of the last decade’s key spirits stories, shaping trends across and within categories.

Distillers often prefer to focus on higher price points or the upper ranges of portfolios, given the better margins available. Premium brands also tend to command greater loyalty among consumers.

Premiumization broadly refers to an extensive pattern of consumers trading up in their drinking choices, but that can take different forms: a move to higher priced versions of the same spirit, or a switch to categories with a more premium positioning (from inside or outside spirits). A shift from often cheaper local spirits to international categories is part of that picture in some emerging economies.

Amid financial concerns, inequality, geopolitical unrest, and environmental breakdown, extravagant and showy displays are falling out of favor. Effective strategies to add value in the eyes of consumers are instead focusing on authentic indications of quality.

The macroeconomic storm is not abating

Despite the extensive cost of living pressures, spirits volumes at the global level, excluding China, remained largely resilient in 2021 and 2022, supported by accumulated savings. In China, prolonged lockdowns and long-term decline in economy baijiu affected performance.

However, continued macroeconomic pressures are now beginning to make a significant mark on purchase patterns across markets.

Recent financial results announced by international distillers indicate that the effects of the current economic environment are already being felt across the industry.

Global economic growth is due to continue weakening into 2024, for the third year in a row. Tight monetary policies and depleting savings are slowing consumer spending and limiting business investment.

Geopolitical tensions threaten supply chains, notably disruption in the Red Sea and the ongoing war in Ukraine, among other risks. A record proportion of the global population will be voting in elections in 2024, shaping policy direction, and disasters linked to climate change remain a profound concern.

Pricing strategies: weighing the options

Over the last couple of years, producers and retailers have increased prices in response to substantial rises in their input costs but managed to avoid incurring any significant loss of volumes. That is the historic view.

Brand owners in premium brackets tend, understandably, to be unwilling to sacrifice margins in search of volumes when consumer price sensitivity increases. Nevertheless, the extent of the current challenges means various short-term strategies may need to be considered.

The options available for targeting affordability are few and far between in spirits. Focusing on home consumption occasions is one approach. In retail, package mix adjustments are limited by the nature of the category, so modifying pricing is the primary strategy available.

Promotional pricing may, by necessity, become more common. Discounting and promotions have clear drawbacks if overused, particularly for premium offers, as there is a risk of devaluing the brand, affecting relationships with suppliers, or altering pricing expectations for the long term.

Any discounting therefore needs to be highly targeted, and market differences, including the prevalence of promotions across FMCG categories, should be considered.

Long-term potential, but no smooth path to premiumization in emerging markets

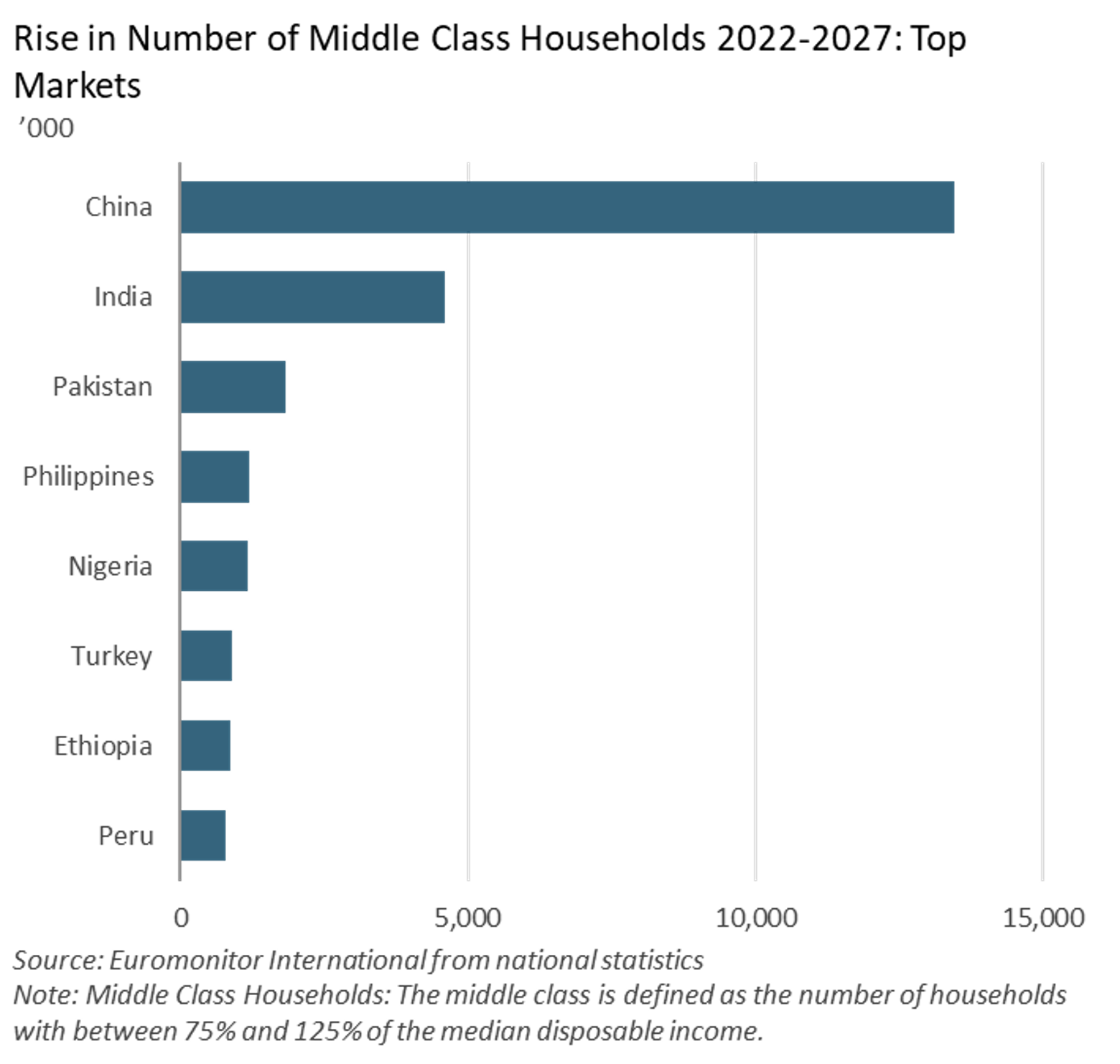

Taking a long-term view, the global premiumization trajectory will be aided by expanding middle-class populations in key emerging and developing markets.

India, for example, is a key target market for leading distillers Diageo and Pernod Ricard. Rising incomes, relatively low per capita consumption, and the aspirational appeal of premium spirits are behind the potential seen in India. While premiumization often prompts a move towards international offers, local, artisanal spirits are also starting to gain traction in India, as elsewhere.

China is the world’s largest spirits market, with local baijiu contributing over 90% of total volumes. However, younger adults are driving growing interest in international categories. The vast potential scale of the premium whisky market in China has led both Diageo and Pernod Ricard to recently open distilleries in China to produce malt whisky, with logistical advantages also in mind.

When considering growth expectations, it is worth noting that the worsening global economic outlook will place pressure on disposable incomes across markets, constraining consumers’ ability to trade up shortly. Setbacks should be anticipated as premiumization progresses.

The rise of Gen Z will accelerate existing demand shifts

The influence of Gen Z on consumer goods industries has received considerable coverage. Spirits is no exception, and the impact will become increasingly evident as more of the cohort reaches the legal drinking age.

Younger consumers have different priorities, habits, and consumption behaviors to previous generations at the same age, and are at the forefront of many of the key trends shaping the industry. The rise of no/low alcohol and the digital space are two obvious examples. However, such developments are gaining traction across age brackets.

Across regions, Gen Z and Millennial consumers place a greater emphasis on saving money than older groups, resulting not only from their comparatively limited income levels but also from the severity of concerns about the future. The impact of COVID-19 and the subsequent cost of living crisis appear to have given rise to a particularly cautious mindset among younger generations. Importantly, if unsurprisingly, they are still keen to spend on experiences, illustrating the extent to which socializing remains a priority despite economic constraints.

Enhancing value for money perceptions will be vital given the careful approach to spending – achieved through added value, not just affordable prices. Analyzing the wants and needs of different generations can be especially useful when viewed as a guide to the direction of change. Heeding the requirements of Gen Z will only gain greater consequences going forward.

The ethical dimension to premium perceptions

Ethical attributes have a growing role to play in defining “premium”. Consumers expect to see their values reflected by brands – in actions not just words. The concept of community was boosted by pandemic restrictions and retains relevance amid the uncertainty and instability prevalent in much of life, prompting support for local businesses and products.

Sustainability is a subject that cannot be ignored. Environmental and social responsibility are priorities that cross generations, but Gen Z consumers tend to be the most vocal. Action on sustainability will therefore help to ensure brands retain long-term relevance.

While debate continues as to the actual impact of sustainability as a purchase driver in alcoholic drinks, activity and visibility are undoubtedly gaining momentum. Retailer requirements are a key part of that, as stores seek to showcase their ethical credentials.

Highlighting progress in a way that aligns with broader brand positioning can strengthen relationships with consumers, especially for premium brands that can build on existing communication around ingredients, locations, and production techniques. Transparency can build trust if communicated appropriately, even for ambitions that are still a work in progress.

Leveraging digital channels: on track for an online future?

E-commerce growth has slowed significantly since the pandemic-driven peak of 2020, and the channel accounts for just a mid-single-digit share of spirits retailing. However, the digital space is becoming an ever-more prominent feature of consumers’ everyday routines – across age groups.

Digital elements are a key and growing component of the purchase journey, and can greatly enhance outreach efforts for premium brand owners. Social media is often essential for connecting with younger adults, who tend to consume less traditional media than older groups. Engaging content and storytelling can extend reach and encourage word-of-mouth promotion.

The counterpoint to the benefits of digital is the need for consistent and considered messaging across online and offline touchpoints; negative commentary can spread just as quickly as positive stories.

Emerging technology is a vital part of the picture. Blockchain is used in tracking provenance – relevant in tackling illicit production and supporting sustainability efforts. Blockchain can also provide valuable reassurance about the credentials of a premium purchase.

AI is poised to be the most disruptive new technology. The use of generative AI for individually tailored product recommendations or mixology will take personalization in premium spirits to another level compared to the initiatives seen so far that are just testing the water.

Old meets new: heritage adds substance to innovation

Consumers sought comfort in familiar brands during the pandemic – nostalgia provides a sense of security in uncertain times. Trust in a name remains an important purchase driver across FMCG categories, but consumers are also keen to explore innovative choices.

Tradition lies at the heart of much aspirational appeal in spirits. From that angle, brands or categories with established status have an advantageous position.

At the same time, the importance of the element of discovery can be seen in the recent rise of artisanal spirits. Consumers are increasingly open to diverse and original options when they trade up. That can include different styles, production geographies, or ingredients.

However, those are alternatives that retain recognizable features. Sudden change is neither expected nor appealing – spirit trends do not move in short-term cycles. World whisky, for example, is without doubt gaining traction, but over a timespan covering many years.

For lasting appeal, new developments should feature genuine quality credentials, which will often include heritage elements, rather than relying on novelty.

Tequila leads the way

Few categories have been so closely associated with premiumization in recent years as tequila. Largely through interest in home mixology, supported by celebrity endorsements and pandemic-related financial factors in the US, tequila (and mezcal) has been one of the best-performing spirits categories. Among leading brands, key super-premium and above examples – notably Don Julio and Casamigos – stand out for the growth rates achieved. Numerous smaller brands have also entered the market at the upper end of the price range. As habits migrate from high-energy settings, with a focus on shots, to sipping occasions, consumers are willing to spend more on a bottle.

Anecdotal evidence suggests growth in super-premium US tequila may be moderating, after years of headline-grabbing rises, although growth continues. Still, brand owners are looking for diversification routes. One is alternatives, which can benefit from distinct flavor profiles and brand stories that add notes of difference. Mezcal is the obvious example to highlight, a bartender favorite, known for being generally smokier than tequila. Raicilla is also produced from agave plants, while Sotol is created from the related “desert spoon” plant. Agave spirit production is on the rise outside Mexico, too.

Geographic expansion is another consideration. Some of the recent growth drivers are US-specific. However, interest in high-end offers is undoubtedly on the rise in other markets, much of Western Europe, for example. Tequila remains a category to watch.

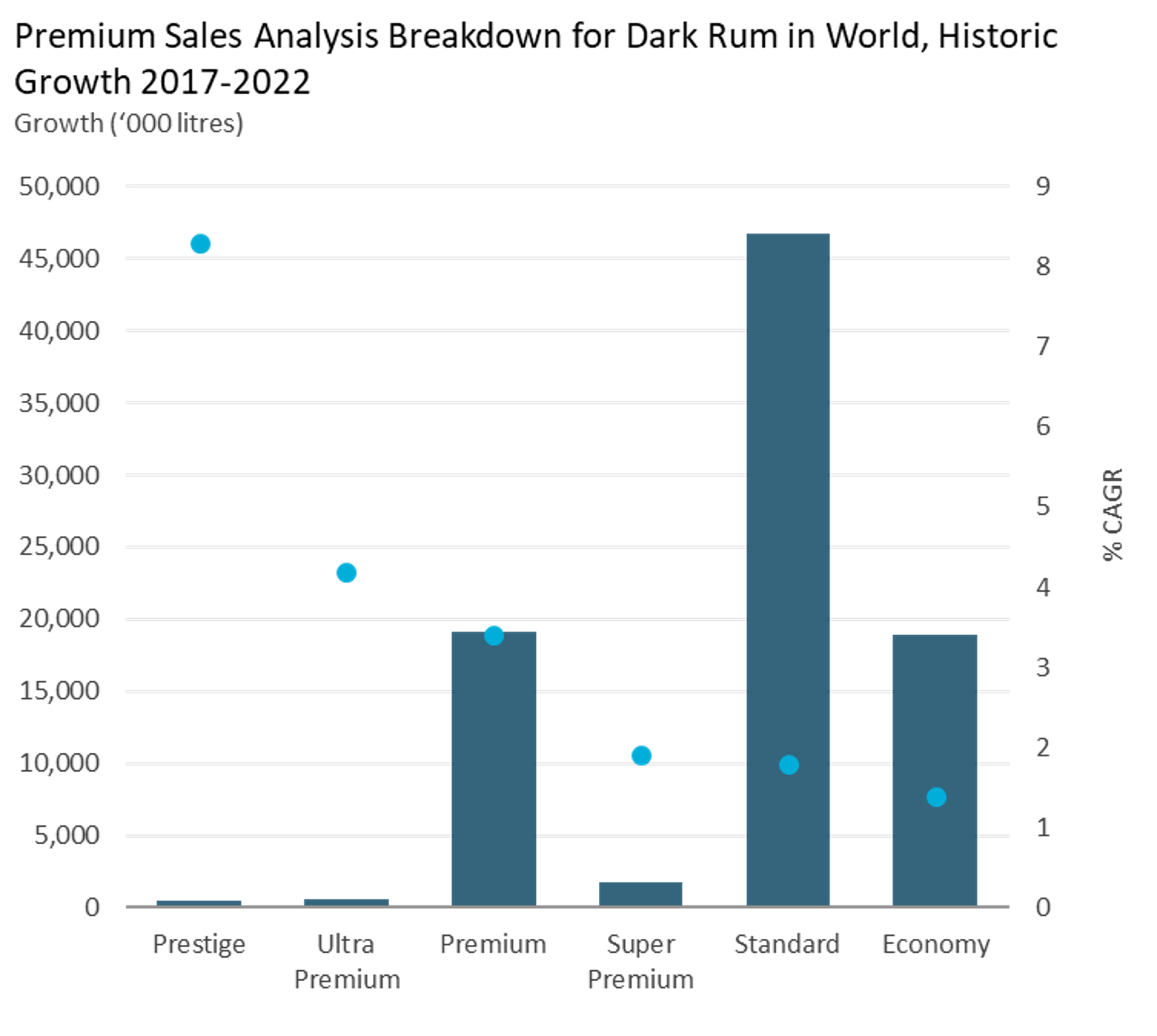

Rum: the next focus for super-premium acquisitions?

Acquisitions across the super-premium and luxury price points have been a key feature in the gin landscape. Geographic origin has often formed an important point of distinction.

M&A activity in the category is slowing significantly, as attention shifts elsewhere. While gin growth remains strong in some markets, such as South Africa and India, it has dropped off in the leading region for the category, Western Europe, especially in the UK.

Rum is now a focal point for high-end acquisitions. Diageo and Brown-Forman have both added super-premium rums to their portfolios in the last couple of years. As with gin, countries of origin are prominent in brand messaging, adding to the background stories of origin.

Rum crosses many different countries, each with its methods, styles, and production histories, which works both for and against perceptions of the category. Production standards vary considerably by geography – compared to the uniform approach in Scotch whisky for example – which can confuse. At the same time, variety adds breadth to rum, helping to draw consumers in and create discussion points.

Single malt whisky: on the rise in Scotch and beyond

At the global level, single malt Scotch whisky has consistently outperformed other blended Scotch over the last decade (from a much lower base level), although volumes of both categories declined in 2020.

Single malt Scotch whisky’s long-standing reputation ensures it maintains international aspirational appeal. Rising middle-class populations in emerging economies such as China and India will support continued strength in the future. Trade agreements may also prove advantageous for Scotch exports.

At the same time, illustrating both premiumization and demand for variety, interest in alternative single malt whiskies is on the rise – famously from Japan, but also from the US and India, among others.

While the US is still primarily associated with bourbons and rye whiskeys, some producers are moving into malt. As awareness and appreciation of single malt produced in diverse locations expands, distinct regional identities will emerge, adding to products’ quality credentials. However, the volumes involved in those alternatives are unlikely to trouble Scotch shortly, at least.

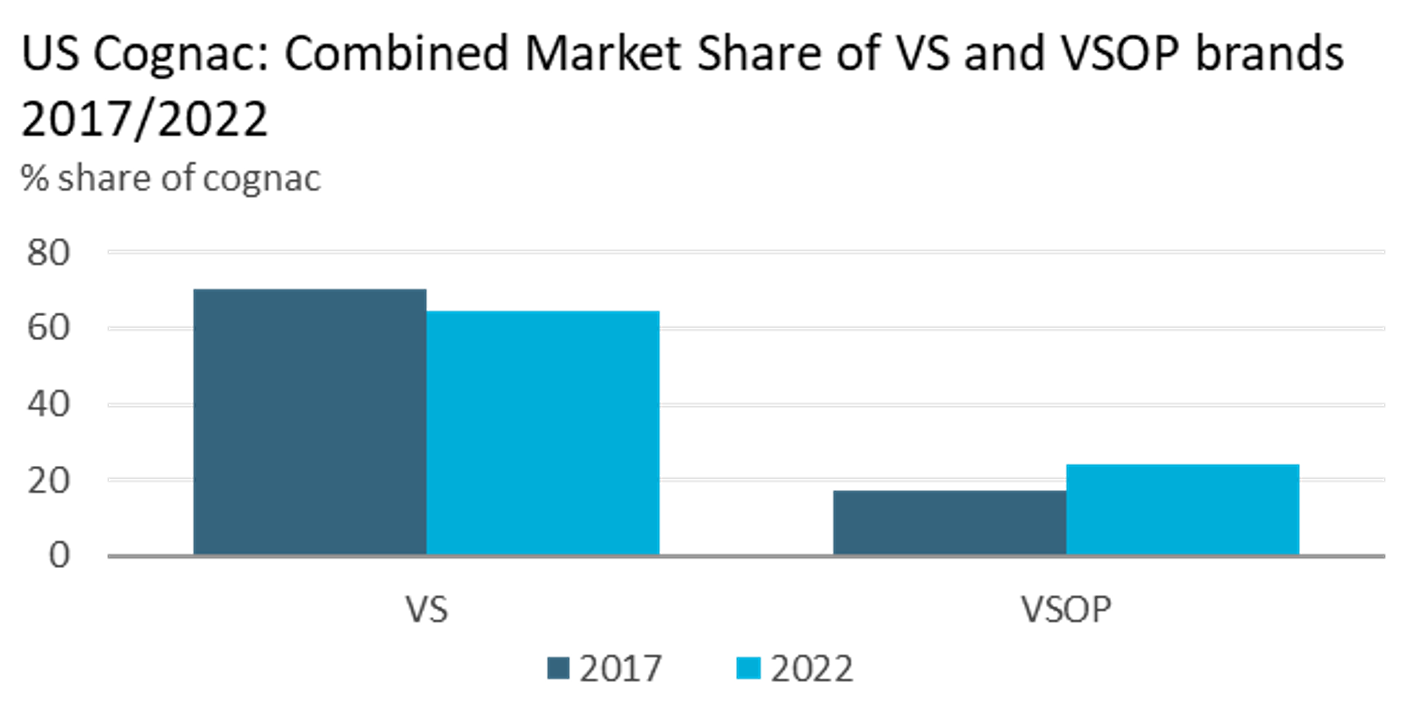

Cognac: passing the peak in the US

Inherently premium cognac recorded a faster pace of global growth over most of 2013 to 2022 than brandy, which is generally seen as more affordable. The US and China are the key cognac markets, together accounting for over 75% of all volumes. Slower-than-expected economic recovery in China is weighing on growth.

In the US, historic premiumization is evident. The combined share of entry-level VS brands in cognac declined slightly over 2017-2022, while higher-priced VSOP variants recorded a rise (albeit from a far lower base level).

Cognac suffered from a widely publicized downturn in the US in the last quarter of 2023, disproportionately affected by the impacts of inflation. Cognac is also losing out to other premium-orientated categories, notably tequila. The question is whether the downturn represents a change of fortune, or just a temporary setback amid readjustment following the pandemic. Cognac’s fit with relaxed, home occasions saw it remain strong in 2020, while other spirits struggled.

Consumers are increasingly category agnostic and will happily switch between alternatives. The challenges facing cognac are significant, and brand owners will need to work much harder to draw aspirational purchases, as more products compete at the upper end of spirits. Occasions and positioning will be important focus areas, with product innovation constrained by geographical indication rules.

Non-alcoholic spirits: premium by nature

While it is younger groups who are spearheading the sober curious movement, no/low alcohol holds expanding appeal across age segments, as much of the consumer base integrates alcohol-free drinks into socializing routines that still feature alcohol. In fact, the limited spending power of those in the younger legal drinking age brackets means broader demographic targets may be a wise approach for non-alcoholic spirits.

The price point of the category usually sits above some way above the spirits average. The gap is likely to close slightly in the coming years, as more affordable alternatives rise – including retailers’ private label offers in markets such as the UK, where private label has a meaningful presence. Price diversity may prove beneficial in expanding appeal, although maintaining quality is imperative as the category builds mainstream acceptance.

Nevertheless, future innovation will remain biased towards the upper end of the price spectrum. Non-alcoholic spirits are inherently premium and will struggle to compete on price with alternatives in the no/low space, or with adult soft drinks.

Differentiation will be key going forward. One possibility can be seen in the first iterations of functional alcohol-free drinks targeting relaxation or social energy need states. Although at an early stage with challenges to overcome, such examples still represent a potential next step.

A strong non-alcoholic offer can help bars and restaurants diversify their offers to draw in consumers across occasions and times of day, and the spirits segment has a key role to play in recreating premium consumption rituals without alcohol.

Tapping into the experience economy

Despite the growing need to cut back on discretionary spending, experiential consumption continues to appeal. Socializing, quality time, and creating memories: these are deemed reasons to spend.

Brand owners can incorporate immersive experiences or lifestyle elements into marketing, including events, partnerships, and sponsorship. The purchase process itself often forms a valuable aspect of consumers’ interactions with luxury brands, in particular.

While they will not supersede real life, digital platforms and innovative technologies, such as augmented reality, have already achieved some success and can help brands capture consumer imagination or enable a more personalized approach.

Taprooms and distillery tours are now very familiar but still present a good opportunity for building connections, with the benefit of enhancing geographic or community credentials.

The on-trade is under immense pressure in many markets, as the considerable period of elevated costs combines with shifts in consumer behavior to create an intensely challenging backdrop. Providing an activity will help draw custom – offering music, art, games, drink tastings or digitally connected community spaces are among the possibilities.

Spirit-based RTDs: trading down, trading up, and branching out

RTDs recorded impressive growth during the pandemic – posting a double-digit rise in 2020, while the rest of the industry unsurprisingly struggled. The category is forecast to considerably outperform total alcoholic drinks over 2022-2027 as well. The spotlight is now directed at spirit-based offers.

The rise of canned cocktails represents premiumization within the ready-to-drink category. At the same time, RTDs also appeal to consumers seeking high-quality retail alternatives to more expensive on-trade purchases. Taking classic cocktails into settings outside of the bar is a core driver of spirit-based RTDs’ recent success.

Extending spirits brands into the ready-to-drink format can expand coverage into new occasions, and at the same time offer a reasonably affordable introduction for consumers who are unfamiliar with a brand. The category remains heavily skewed toward retail, but premium canned or pre-batched options can also encourage consumers to trade up in smaller on-trade venues or high-footfall settings where custom cocktails are not feasible.

While RTDs are mainly associated with single-serve packaging and will remain so, some distillers are releasing premium sharing (“ready-to-serve”) bottles of well-known cocktails, targeting the enduring popularity of at-home socializing. Community settings, whether on-trade or off-trade, inherently favor aspirational consumption. Such developments provide a good example of how premiumization efforts can adapt to changing behavior.

Key Conclusions and Considerations

The ethical dimension needs consideration

Environmental and social responsibility is becoming a vital component of perceived added value, as consumers expect brands to reflect their ethics. Transparent communication highlighting progress, and challenges too, will build trust.

Such messaging can support and enhance premium brands’ existing commentary around ingredients, stories, and production techniques.

Invention appeals… within limits

Curiosity is a key feature of spirits demand; lesser-known categories, artisanal brands, or innovative non-alcoholic options hold growing appeal.

However, spirits are not driven by rapid cycles of renewal, and consumers are not seeking complete change. Innovation that offers a twist on the familiar, often incorporating heritage cues, will target interest in discovery, while remaining comfortably recognizable.

Experiences are still seen as a reason to spend

Offering social, creative experiences has always been a reliable way to enhance the value proposition of a brand, but the need to leave a memorable impression is more vital than ever.

Incorporating digital elements into real-life events can prove highly effective. Augmented reality or personalized creations devised by generative AI are expanding the horizons of what is possible.

For any additional opinions or questions email info@pacrimdistributors.com