Beer in Norway - Market Forecast 2023

KEY DATA FINDINGS

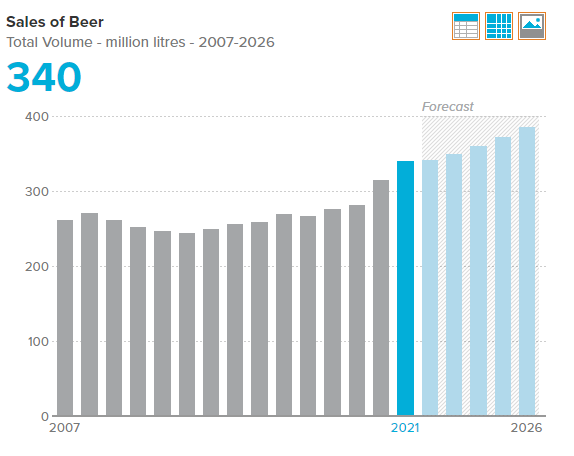

Off-trade volume sales of beer rise by 8% in 2021 to 306 million litres

Imported premium larger is the best performing category in 2021, with total volume sales increasing by 13% to 18.9 million litres

Ringnes AS remained the leading player in 2021, with a total volume share of 36%

Off-trade volume sales of beer are set to exhibit a CAGR of 2% over the forecast period to 341.7 million litres

2021 DEVELOPMENTS

Cross-border trade remains subdued

Having surged by almost a quarter during 2020 amid the imposition of COVID-19 restrictions, the rate of growth in off-trade volume sales of beer slowed significantly in 2021 but remained robust. Premium larger, particularly imported premium larger, was the top performer. However, domestic mid-priced larger continued to dominate off-trade volume sales. Cross-border trade (mainly local consumers travelling to neighbouring Sweden) did not resume to any large extent in 2021, as the relaxation of restrictions at the end summer was swiftly followed by the tightening of restrictions, as the incidence of COVID-19 resurged later in the year.

Health trend boosts consumer interest in no-lo

Off-trade volume sales of no-lo (no or low ABV) offerings continued to expand during 2021, buoyed by the health and wellness trend. Younger consumers in particular are increasingly ‘sober curious’—reducing their alcohol intake or completely abstaining from alcoholic drinks. Demand for lite beer, which has reduced calories, has been boosted by the fact that a growing number of local consumers are watching their weight. The pandemic has played a role in this by drawing attention to the long-term health risks associated with being overweight or obese. In 2020, the launch of low-alcohol Hansa Radler was well received by local consumers.

Fruity trend expands beyond IPAs

Exotic flavours are growing in popularity within beer. Hansa Bryggeri launched a Mango IPA in Norway during 2019 that proved popular with local consumers. It followed up this success in May 2021 with the launch of Hansa Mango IPA Lite, which contains fewer calories and is gluten free. Initially a limited edition, its success meant that it was added to Hansa’s regular selection.

Hansa also successfully launched Ananas IPA (Pineapple IPA) in May 2021. Many of Hansa’s rivals have launched similar products. Ægir has launched a mango version of Dag citrus pale ale. It continues to experiment with new flavours, such as Habañero Helles Chili Lager and Piña Colada Tropical Wit. According to trade sources, some local consumers will replace one or two beers from their regular six pack of lager with fruit IPAs for variety. However, others in the industry assert that fruit-flavoured IPAs are “vulgar,” while at the same time brewing fruity beers with such ingredients as raspberries.

Carlsberg-owned Ringnes maintained its leading position in beer during 2021 with its solid foothold in domestic premium and domestic mid-priced lager. Hansa Borg remained the second-ranked player, but it continued to be impacted by intense competition in domestic mid-priced lager.

PROSPECTS AND OPPORTUNITIES

Relaxation of pandemic restrictions will lead to normalisation of cross-border trade

The rate of growth in off-trade volume sales of beer will slow significantly during the forecast period, as COVID-19 restrictions are relaxed and the cross-border trade to Sweden and (to a lesser extent) Denmark resumes. This will particularly be the case in 2022. Conversely, there will be a significant increase in on-trade demand, as bars and restaurants resume normal operations. Radler and flavoured beer will continue to grow in popularity

Craft beer will struggle to compete on price

While the craft wave reached its peak during the review period, Norwegian consumers have now a taste for far more than the traditional lager variant. Although lager still constitutes the lion’s share of volume sales, new beer types, particularly ale, is expected to continue to grow at a strong pace over the forecast period. However, price will be a key issue. The high-unit prices of domestic small-scale breweries are a barrier to growth, and the big players and retailers could curb their development. The bigger breweries are launching their craft beer offerings of their own at more affordable prices and retailers are narrowing down their product selection and becoming more demanding regarding inventory turnover.

Deepening health trend will continue to support demand for no-lo

In spite of the waning pandemic threat, the health trend will continue to boost demand for non-alcoholic and low alcohol beer, in addition to lite beer. The launch of higher quality products, a wider product offer and wider distribution will be key to this. Positioned within premium and above price points, the segment will continue to provide opportunities for growth over the forecast period.

CATEGORY BACKGROUND

Lager price band methodology

Assigning price bands to Norwegian lagers is complicated as the prices charged for the brands are often highly dependent on excise taxes. In terms of economy lager, Euromonitor International has chosen products that are private label and regular brands with an ABV of below 4.7% as benchmark brands. All imported lagers fall into the premium price band. For domestic premium lager, both brands with an ABV in excess of 4.7% and seasonal summer and Christmas beers are included, as both of these types have a higher-than-average unit price. The majority of leading beer brands in Norway fall into the mid-priced segment, as differences in price, positioning and packaging are marginal.