PACRIM's GUIDE TO RTDs IN CHINA

KEY DATA FINDINGS

RTDs are exploding in China with concentration in Shanghai, Guangzhou, Chongqing and Tianjin.

Popularity among young consumers driving the growth of RTDs

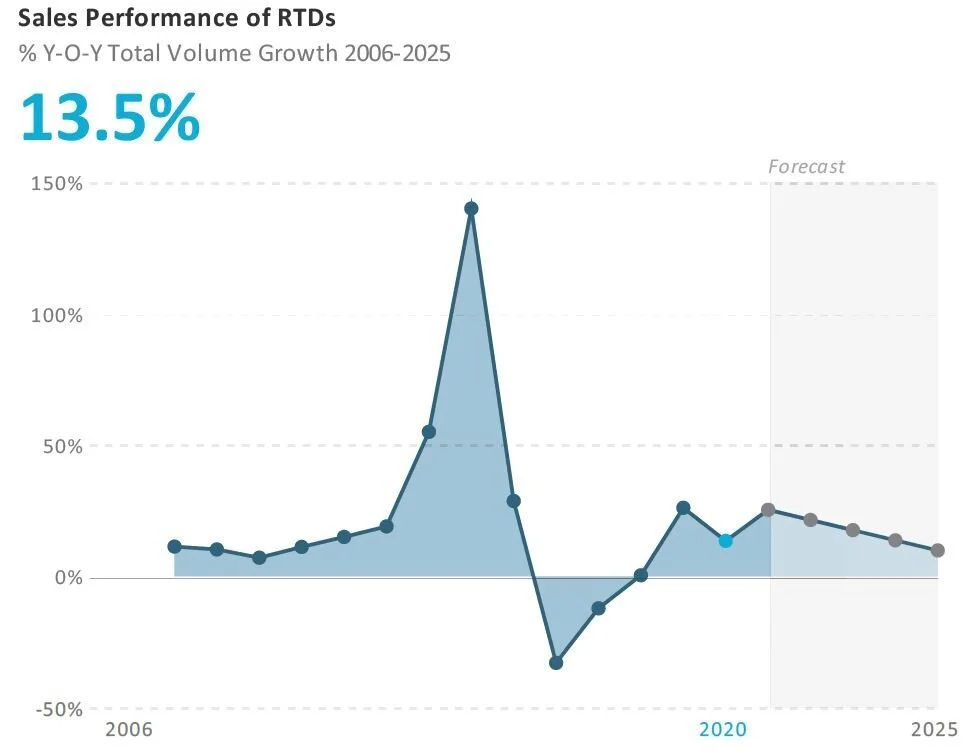

RTDs records 14% total volume growth to reach 129.2 million litres in 2020 with robust growth expected in 2021 thru 2025

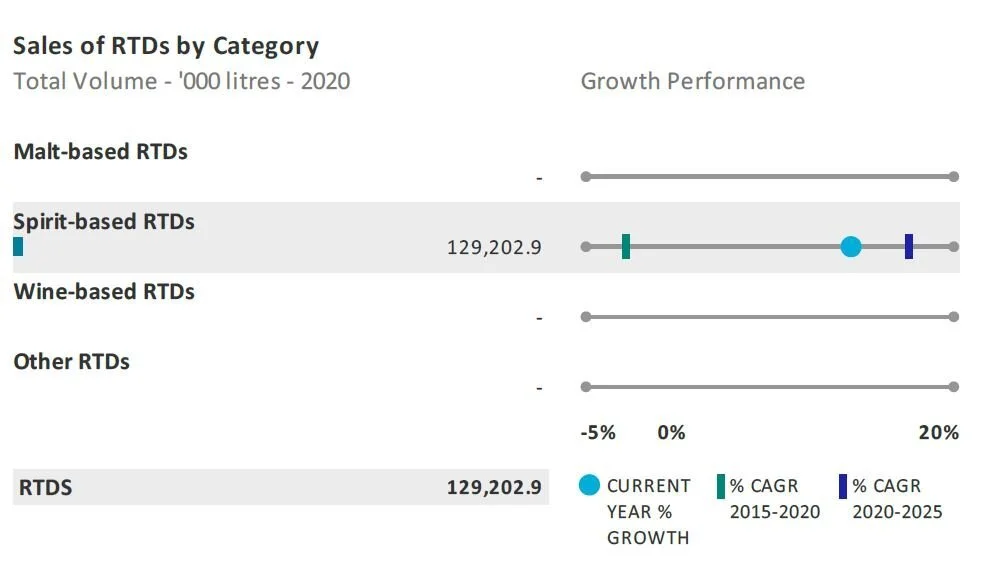

Spirit-based RTDs, still the only category in RTDs, records the highest total volume growth rate of 14% in 2020

The average unit price declines by 6% in current value terms in 2020

Shanghai Bacchus Liquor continues to dominate RTDs with an 87% total volume share in 2020. Artisinal RTDs continue to launch in the market.

RTDs to record an 18% total volume CAGR over the forecast period, reaching 288.8 million litres in 2025

1231313123.JPG

2021 IMPACT

Dynamic volume growth for RTDs in China

Although total sales volume of RTDs was still dynamic in 2021, growth was down significantly due to the impact of COVID-19. With on-trade establishments such as restaurants and bars being shut down in the first quarter of 2020, this heavily impacted sales of RTDs in this channel. However, in the off-trade, the sales volume actually saw stronger growth in 2020 than a year earlier, largely thanks to the drinking occasions switching from on-trade establishments into people’s homes, as well as the wide availability of RTDs on online B2C platforms. Moreover, leading RTDs player Shanghai Bacchus Liquor Co Ltd expanded the coverage of its Rio brand into low-tier cities and allocated resources for more efficient channels such as internet retailing to achieve further off-trade growth in 2021. We’ve seen the growth of RTDs in coffee, and now this trend is heavily expanding into alcohol.

Rio exploiting cross-category innovation

Although Rio from Shanghai Bacchus Liquor already accounts for an 87% off-trade volume share in RTDs, the company is still actively looking for innovations for the brand to help it achieve further growth. In July 2020, Rio opened its first hand-made milk tea store in Shanghai under the name RioLab, seeing the brand enter the consumer foodservice field. The store features Rio as the base in its hand-made beverages, and has been attracting a lot of young consumers. This cross-category innovation greatly helps to further raise brand awareness among consumers.

1412341231.JPG

RECOVERY AND OPPORTUNITIES

Low-alcohol and easy-consumption nature to drive further growth

Spirit-based products dominate RTDs in China, although RTDs do not tend to be closely associated with spirits. RTDs tend to be displayed on shelves and in fridges together with soft drinks. Pre-mixed with juice and soda, RTDs are characterised by relatively low alcohol levels and their ease of consumption, which makes them very popular among young adult consumers. Thanks to the increasing health education, more people are becoming aware of the harmful health effects of alcohol, particularly products with high ABVs. RTDs are therefore benefiting from their low alcohol content, offering a good balance between attempts at healthier living and indulgence. In addition, the ready-to-drink attribute allows for more diversified drinking occasions, such as at home and in restaurants. It breaks through the boundaries of only being good for consumption in a bar, enabling consumers to enjoy cocktail-style products more widely.

Still niche rice wine-based RTDs could also offer potential

One interesting development in 2020 and in the coming years that could offer further hope to the category is the niche of rice wine-based RTDs. This category greatly retains the aroma and taste of both rice wine and non-alcoholic drinks in one bottle. It also features brands such as Shi Zi Ge Ge from Shaanxi Wu Shi Xian Wine Industry, Zhuo Ye from Danyang Yihe Food and Xiang Dun Dun from Shaoxing Shunwang Fruit Wine. These products are mainly sold via online platforms and consumed by the young generation and female consumers.

15618615.JPG