Craft Beer in Malaysia to Experience Sharp Rebound Thru 2024

Despite a heavily Muslim population, Malaysia has historically been a very good market for craft beer in recent years, with the craft cocktail scene burgeoning and giving rise to craft beers in tow. Obviously Covid-19 has depressed the market, but with a vaccine on the horizon and consumers keen on new tastes, the market will experience a healthy rebound in 2021.

HEADLINES

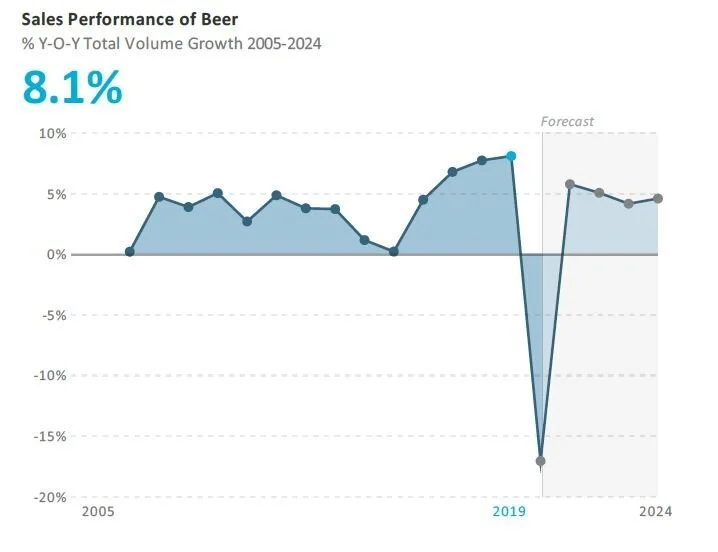

The COVID-19 lockdown kicks into touch on-trade sales for many weeks in 2020, leaving consumers to rely on the smaller retail channel for their beer. Smaller craft beer outlets struggling initially fo rviability.

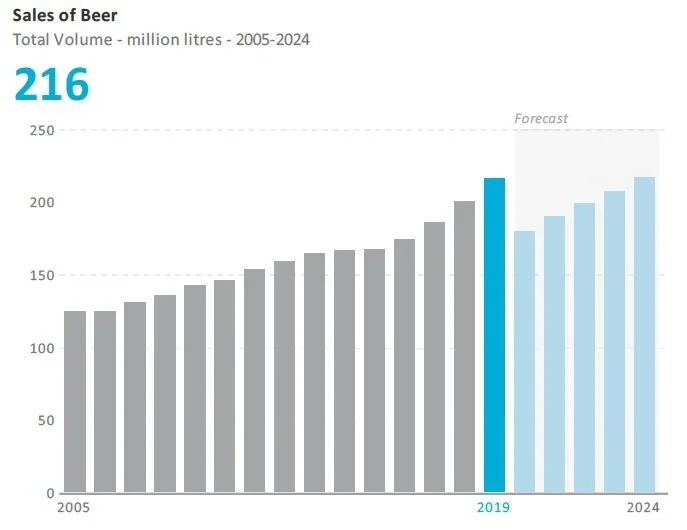

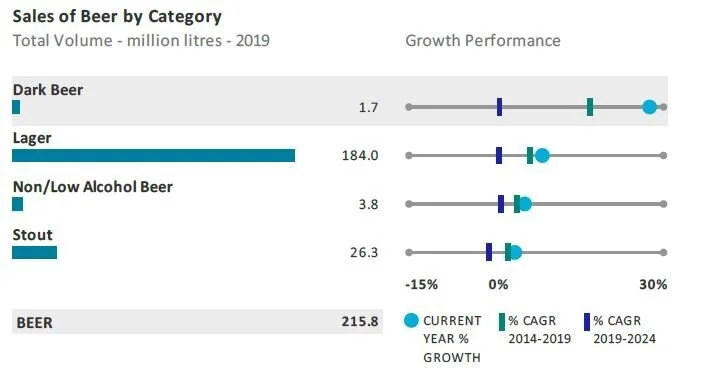

In 2019, total volume sales grow by 8% to 216 million litres

Rising sophistication sees more consumers develop a taste for premium and craft beer in 2019. Smaller players growing in share, craft momentum steadily increasing.

The category with the highest total volume growth in 2019 is weissbier/weizen/wheat beer, with a 28% sales increase

The average unit price rises by 5% in 2019

Heineken Malaysia Bhd leads total volume sales with a 55% share in 2019 Over the forecast period, sales are projected to record a total volume CAGR of 0% and remain at 216 million litres in 2024

Craft Beer Forecast Malaysia

PRE-COVID-19 PERFORMANCE

Price rises no deterrent to consumers seeking higher-quality or unique beer

In 2019, beer continued to experience a shift towards premiumisation, which included greater interest in Belgian and German beers as well as a growing number of craft beer brands available in the local market. While consumers have been adjusting to the higher sales tax rate, which has been passed on to the final price by manufacturers, factors such as low inflation and strong population growth in Malaysia have seen strong total volume growth in beer, with mid-priced and premium lager registering accelerated rates in 2019. Residents are increasingly sophisticated, seeking out more interesting and higher-quality beverages.

As part of this trend, craft beer is beginning to enter the mainstream, having previously only been available through speciality bars and cafés. It can now be found in major supermarkets such as Village Grocer, BIG Supermarket and Cold Storage. Craft-style beer brands such as Brooklyn Lager by Carlsberg Brewery Malaysia Bhd were also reported to be posting strong growth.

Craft Beer Malaysia Growth Forecast 2025

Heineken keeps a high profile at the category summit

Heineken Malaysia continued to lead the beer category with a strong share in 2019, aided by its dominant performances in the domestic larger and stout categories. With its long-standing brand names and wide offerings, the player has established a prominent presence and secured a high volume share in the beer category. In 2019, Heineken pushed marketing activity in East Malaysia, leveraging beer and food pairing events in conjunction with the Harvest Festivals in Sabah and Sarawak.

In the food pairing events, Heineken was able to match its different lagers, stouts and ciders with a range of traditional Kadazandusun and Dayak cuisine. In 2018, Heineken continued to lead large-scale campaigns to engage brand followers, such as the Tiger Uncaged Street Food Festival, The Great Brew Fest, as well as the Roar with Tiger events tapping into the 2018 FIFA World Cup heat.

Lifestyle changes create space for non/low-alcohol beer

Non/low-alcohol beer continued to gain traction and popularity in 2019 amid a more curious consumer base pursuing the healthy living trend. These beverages, the majority of which contain no alcohol at all, serve as alternatives for drinkers to enjoy in the afternoon, and for professional occasions or when the need to drive arises. They are also very affordable and sales growth in recent years has been strong and steady. 2019 saw the launch of Heineken 0.0 in non/low-alcohol beer, and it was accompanied by Kirin Perfect Free beer and Asahi Dry Zero Free beer, although marketing campaigns and consumer messages were clear in communicating that the products are for non- Muslims of 21 years old and above only, are non-halal and should not be drunk by the underaged.

2020 AND BEYOND

COVID-19 impact

Retail sales of beer are now expected to grow by just 4% in volume terms in 2020 overall, in light of the impact of COVID-19. This compares with a 5% rise in sales forecast in Euromonitor International’s 2019 edition of alcoholic drinks. In the on-trade, beer sales are set to post a huge 28% decline in 2020, having been projected to increase by 5% in the previous edition.

Given the widespread closures of bars, pubs and restaurants, some consumers have been shifting towards the retail channel. Hypermarkets and supermarkets are predicted to have experienced the most demand accordingly, since alcohol specialist stores are likely to be closed temporarily or are seeing less footfall. However, large deceleration in disposable income increases, arising from many job losses and fewer working hours on account of the lockdown, is seeing consumers spending less on alcoholic drinks in the off-trade.

Craft Beer Malaysia Format Forecasts 2024

Affected products within beer

Although sales were niche, craft beer has been hit hard by the on-trade closures since most of its consumption is generated in horeca and other foodservice outlets. Similarly, weissbier/weizen/wheat beer posted the fastest sales growth in 2019; however, its bigger share is in the on-trade and therefore the lockdown has taken the wind out of its sails considerably although its retail performance is set to remain strong in 2020.

Imported premium lager is set to post the worst performance overall in the year, as another category relying more on the much-diminished on-trade. Home seclusion in Malaysia has been enforced by the implementation of the Movement Control Order, and was especially restrictive between March and May. As such, foodservice consumption of imported premium lager, as with other beer types, has been severely hampered. Retail sales of imported premium lager are also predicted to be negatively affected, albeit to a much lesser degree, owing to the erosion of purchasing power.

Recovery and opportunities

Most businesses in Malaysia are now allowed to operate again, although those in the on-trade that survived the lockdown and are now offering eat-in services again have to abide by state government practice in regard to keeping the COVID-19 infection rate down. Outlets will therefore be implementing social distancing measures, including keeping tables 2m apart, while recording the names of customers frequenting the premises as part of track and trace systems. Because of all these new introductions and wariness among consumers of the lingering threat of infection from group gatherings, trade is likely to be muted compared with a year ago, which will keep this channel’s beer sales down in 2020 as a whole. Retail performance is likely to improve over the remainder of the year as many off-trade outlets that stock beer have been allowed to reopen. As more people venture out to bars and pubs again, the small shift in consumption from on-trade to off-trade in 2020 is likely to be reversed and play a part in retail sales declining slightly in 2021, especially as the on-trade traditionally generates the most beer sales.

E-commerce may present an opportunity for beer over the forecast period. The channel has established a strong foothold in Malaysia and more consumers are now turning to purchasing beer online. This is encouraged by a flourishing number of online retailers carrying beer such as boozeat.com and hermiu.com, which are constantly expanding their product offerings and variants. The lockdown has only exposed e-commerce and these sites even more among locals. Consumers are able to research products on information and compare prices across websites before purchasing. To leverage on the growing convenience trend, in 2018 leading beer player Heineken Malaysia introduced its own e-commerce site Drinkies.my, marketing Heineken’s house brands and offering exclusive promotions and gifts for the site user. Heineken has since catered to growing demand by introducing Draught@Home service to provide home users with fresh beer served on tap, along with free barman services and amenities such as cups and stands.

E-commerce, while still a niche channel for beer, is set to grow as online shopping becomes more popular in Malaysia. It is foreseen that more beer players will seek to expand their online presence through partnership with major online alcohol retailers, in order to adapt to the millennials’ shopping behaviour. Nonetheless, over the forecast period on-trade is expected to remain the most significant distribution channel and continue to drive category growth.

Craft Beer in Kuala Lumpur

CATEGORY BACKGROUND

Lager price band methodology

The premium lager segment consists solely of imported brands such as Corona Extra, Stella Artois and Budweiser. The mid-priced band consist of both imported and domestic brands such as Tiger, Carlsberg Green Pilsner and Singha.

The economy range also consists of both imported and domestic brands such as Skol and Chang. Imported premium lager brands mainly target high-income consumers, expatriates, tourists and sophisticated Malaysian residents who prefer the taste and texture.

Premium - Above MYR $30 per litre

Mid-Priced - MYR $20 to $30 per litre

Economy - Below MYR $20 per litre