Premiumization is Reshaping the Beer Industry in China

The state of the craft beer market in China is dramatically shifting - effects which are increasingly compounded by Covid-19 and the shift to online retail consumption. Craft beer in China is exploding, and importers, distributors, wholesalers, and online retailers will need to reshift their business model towards more premium products to survive.

Craft Beer In China - Bottle house.jpg

HEADLINES

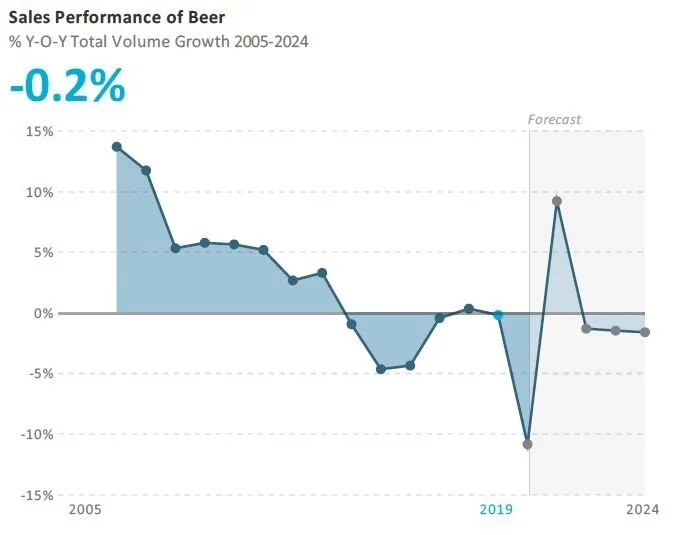

Beer to see declining volume and value sales in 2020 due to the COVID-19 pandemic

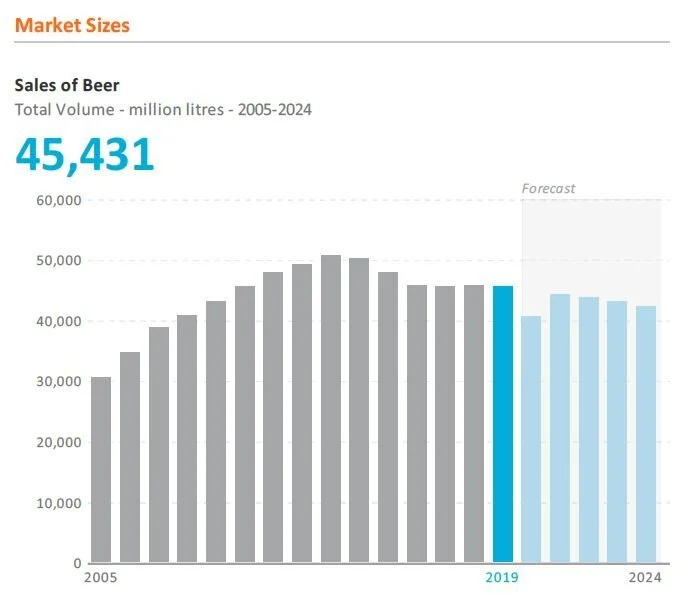

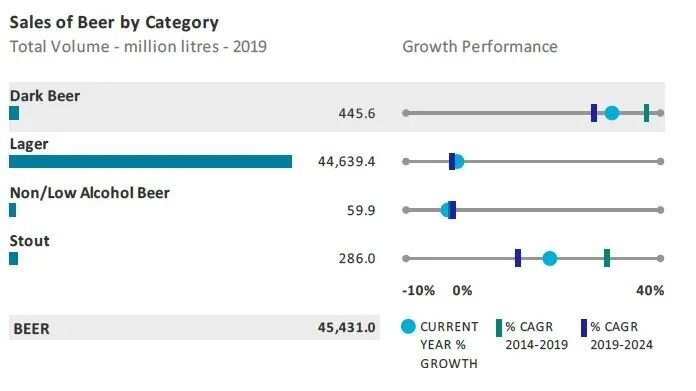

Beer sales stagnate at 45.4 billion litres in total volume terms in 2019

The premiumisation of beer is driving value growth as volume sales stagnate in 2019

Weissbier posts strongest total volume growth of 31% in 2019

The average unit price increases by 6% in current value terms in 2019

China Resources Beer (Holdings) Co Ltd continues to lead with a total volume share of 25% in 2019

Beer is expected to record a declining 2% total volume CAGR over the forecast period, falling to 42.2 billion litres in 2024

Craft Beer in China - Forecast 2024

PRE-COVID-19 PERFORMANCE

Premiumization is reshaping the beer industry

Although the total sales volume of beer was stagnating in 2018 and 2019, the beer industry was recording significant current value growth in these two years, driven by the premiumisation of the beer industry. Both local and international beer manufacturers continue upgrading their product portfolios, as they all look to expand their mid-priced and premium lager product lines. China Resources, Chongqing Brewery, Carlsberg and Yanjing Brewery introduced a series of high-end beers, which is reflected in the strong growth of mid-priced and premium lager, especially imported premium lager, while economy lager has been seeing a negative volume growth. In addition, the increasing per capita disposable income in China is also helping to shift consumer preferences from quantity and affordability to premium products, as consumers are showing a greater interest in the quality and taste of their beer products and an increasing willingness to pay more for premium beer.

Weissbier/Weizen/Wheat beer and stout record dynamic growth

Weissbier/Weizen/Wheat beer and stout, which are relatively new products to the Chinese market, continued to record dynamic volume growth in 2019. Being different from standard lager, weissbier uses wheat as the raw material when brewing, which leads to a greater richness in aroma and head and a more refreshing feeling than standard lager, giving consumers a better sense of visual and taste enjoyment. Riding on this trend, domestic beer giants Yanjing Brewery and Tsingtao Brewery introduced their weissbier products over the review period, targeting young and high-end consumers. Stout, on the other hand, is made from baked malt or barley, providing a delicate head, extremely dark colour, and scorched taste. Such a rich and thick taste is helping to attract attention among local consumers, contributing to its strong growth.

Currently with a niche presence in beer, craft beer is also enjoying promising growth in China, which is reflected in the emergence of a series of domestic craft beer brands and craft beer bars. Although craft beer has become a hot trend in the beer industry, there are problems occurring during its development due to the lack of uniform standards for craft beer. In order to standardise the development of craft beer in China, China Alcoholic Drinks Association (CADA) approved the draft Craft Beer and its Production Specification regulations on 25 April 2019, which entered into force from 1 October 2019. The draft comprehensively standardises the craft beer industry from the perspective of personnel, machinery, raw materials, brewing methods and brewing environment. These official industry standards are expected to help craft beer experience a more dynamic development in the future.

Craft Beer in China - Growth Rates 2024

China Resources Beer continues to lead in beer against a backdrop of declining brewery numbers.

China Resources Beer (Holdings) Co Ltd continue to lead beer in China in 2019, based on its strategy of product innovation and acquisitions. From the perspective of product innovation, China Resources launched a new premium lager called Craftmanship, which is a high-quality beer to pair with flavoured food. In addition to Craftmanship, China Resources also introduced Brave the World SuperX as well as Snow Marrs Green to provide impetus in terms of value enhancement as well as the renewal of the Snow brand. The launch of new products is also expected to propel the future growth of high end products at China Resources. In addition to product innovation, China Resources completed the acquisition of Heineken China’s operations in early November 2018. The acquisition provides an important strategic opportunity for China Resources to further consolidate its presence in the domestic beer industry, especially the premium segment.

Budweiser Brewing Company APAC Limited, a part of Anheuser-Busch InBev NV, successfully completed its initial public offering (IPO) in Hong Kong on 11 September 11 2019. Having recently sold its Australian unit to Japan’s Asahi Breweries Ltd, the company stresses that the APAC business is “all about China”. Currently, Budweiser Brewing Company APAC has more than 50 brands in China, including international brands like Budweiser, Corona or Hoegaarden, as well as local brands like Harbin, Sedrin or Boxing Cat. As premiumization of beer in China continues, Anheuser-Busch InBev is highly likely to shift its focus from economy lager to premium lager to ensure future growth. Budweiser Brewing Company APAC’s successful IPO is expected to increase investment in the Asia Pacific region, especially China, and contribute to the expansion and localization of Budweiser Brewing Company APAC.

According to the National Bureau of Statistics, the number of beer breweries above designated scale size has been decreasing for a number of years. The overcapacity and sluggish growth in the beer industry is the main reason leading to the shutdown of beer brewery sites. Chongqing Brewery had closed eight factories in four years by the end of 2018, in order to improve regional productivity and profitability. China Resources’ shutdown of 13 inefficient factories in 2018, as well as the completion of the acquisition of Heineken China’s operations, indicates that China Resources is trying to optimize its production operations. Tsingtao Brewery, Beijing Yanjing Brewery, Guangzhou Zhujiang Brewery and Carlsberg Brewery have also closed some inefficient breweries to adjust their production capacity.

Craft Beer in China - Styles through 2024

2020 AND BEYOND

COVID-19 impact

On-trade volume sales of beer are expected to fall by 16% in 2020 in light of the impact of COVID-19. This compares to an expected marginal decline forecast for 2020 during research conducted in May 2019, ie before the spread of COVID-19. Off-trade volume sales will fall by 6% in 2020 due to COVID-19’s impact. This compares to the marginal decline expected for 2020 during our research conducted in May 2019.

The shutdown of on-trade channel establishments, such as restaurants and bars, in the first quarter of 2020 heavily impacted the sales of beer, especially in the on-trade channel, where beer plays an important role in social and festival gatherings. The cancellation of international sports events such as the Tokyo Olympic Games and the European Football Championship is also likely to have negatively affected beer sales in 2020.

Affected products within beer

With the government ordering the cancellation of social and festival gatherings, the demand for beer shifted from bars and restaurants into the home. Volume sales in the off-trade channel were less impacted than those in the on-trade channel, considering the stay-at-home orders. Internet retailing was also seeing significant growth thanks to the wide availability of beer products through this channel and with consumers stuck in their homes.

Although an increasing number of restaurants started to launch take-out services to minimise their losses, they were far short of coming anywhere near to offsetting the dine-in sales losses they had experienced. The cancellation of international sports event such as Tokyo Olympic Games and European Football Championship was also expected to negatively affect sales in on-trade channel, but also off-trade, in 2020.

While most lager types were recording declining sales in 2020, weissbier continued to record dynamic growth in both value and volume terms, with stout also turning in positive performances. Imported premium lager also continued to outperform the overall beer category in 2020.

Recovery and opportunities

Beer will record a strong rebound in 2021 in both volume and value terms, although sales will then be a little slower over the rest of the forecast period in value terms (at constant 2019 prices) and will slip into negative territory in volume terms. Weissbier will continue to be the most dynamic product type over the forecast period, with stout and imported premium lager also performing well.

The stronger value than volume performance over the forecast period will reflect the increasing premiumisation in the beer industry, with both local and international beer players upgrading their product portfolios and expanding their mid-priced and premium lager product lines. This will be reflected in the healthy value CAGRs for midpriced and premium lager, particularly imported premium lager, over the forecast period, with economy lager recording a negative value CAGR. Increasing per capita disposable income in China is likely to continue to help move consumer preferences away from quantity and affordability towards premium products. In addition to the more expensive types of lager and hot new dark beer products such as weissbier, these trends should also favour craft beer, which should be given further momentum by the official craft beer industry standards that were recently introduced in China for these products.

From a retail distribution perspective, the strong growth already being recorded by ecommerce in recent years in the sales of beer will receive further impetus as consumers favour the home delivery aspect of this style of retailing, with many people keen to avoid shopping in physical stores during a pandemic. Nevertheless, despite continuing to lose sales share, independent small grocers and supermarkets will remain the two main retail distribution channels over the forecast period

CATEGORY BACKGROUND

Lager price band methodology

China Resources, Tsingtao Brewery, Anheuser-Busch InBev, Beijing Yanjing Brewery and Carlsberg Brewery lead the beer industry, with a strong presence in the premium, mid-priced and economy segments. Premium lager in China includes Budweiser, Tuborg, Heineken, Corona and Carlsberg. Mid-priced lager in China includes Pabst Blue Ribbon, Nanchang Beer and Kingway. Economy larger in China includes Harbin, Laoshan, Hans and Tsingtao Shanshui.

Premium - over CNY $14.00 per litre

Mid Priced - between CNY $7.00 - 14.00 per litre

Economy - below CNY $7.00 per litre.