Competitive Strategies in Beverage Alcohol and Craft Beer

Key Findings

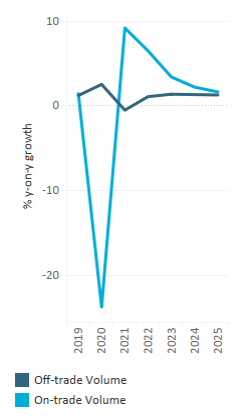

Navigating the path of recovery

Alcoholic drinks companies demonstrated swift adaptation efforts in 2020, although the emphasis on retail sales only partially offset the volumes lost through the collapse of the on-trade. Challenges and setbacks are still to be expected, but the revival of the on-trade appears to be progressing well and should support industry recovery in the short to medium term.

Diversification takes center stage

Leading companies have been increasingly branching out beyond their core product offering, within alcoholic drinks and further afield. Diversification in search of growth is far from a new occurrence, but the trend is accelerating as consumers reduce their alcohol intake in many key markets and drinking patterns become less rigid.

The importance of affordability

Premiumisation remains at the heart of leading players’ strategies in their value generation efforts. At the same time, there are advantages to a flexible approach and offering affordably positioned options where appropriate. This has established relevance in key emerging markets but is expected to become more widely applicable as polarisation gains traction as a result of the economic knock-on efforts of the pandemic.

Craft begins to suffer as priorities change

Reversing the pattern of recent years, craft lost out to mainstream brands during the lockdown. Consumers prioritized the comfort offered by familiar names over the discovery-driven nature of craft beer and alcohol. Although the sector faces ongoing challenges, significant potential remains. Enhancing community links will help micro-producers to tap into the consumer desire to support local businesses.

The future is digital

The expansion of direct-to-consumer capabilities is a core feature of the dynamic recent rise of e-commerce. Digital channels are also becoming increasingly prominent in efforts to connect with consumers. This represents a long-term shift in behavior, and companies from the largest international players to micro-producers are seeking involvement to avoid being left behind.

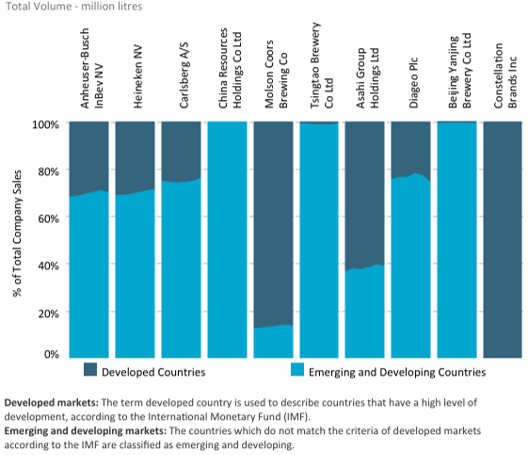

Emerging markets still dominate leading company values

The majority of leading alcoholic drinks companies to rely on emerging and developing markets for most of their volumes. US-based Molson Coors and Japan-based Asahi and Kirin are the notable exceptions.

Value-generating developed markets have been a focus of Asahi and Kirin’s recent geographic expansion efforts in beer. Building on previous transactions, Asahi completed its takeover of Australia's Carlton and United Breweries in 2020 and Kirin acquired New Belgium Brewing, one of the top US craft-style brewers, in 2019.

Molson Coors’s reliance on the mature US market places it in a somewhat risky situation. The company has been exploring categories adjacent to alcohol, such as cannabis, as part of sensible diversification efforts.

Significant share gains for top hard seltzer brands

Levels of consolidation vary widely across alcoholic drinks categories. Beer, cider/perry and RTDs are the most consolidated.

Globally, wine remains highly fragmented. Companies’ wine volumes tend to have a very narrow geographic focus - usually centred on just one or two markets.

Spirits has seen a gradual increase in consolidation over the past five years.

Leading players in hard seltzer, Mark Anthony, through White Claw, and Boston Beer, with Truly, have been spearheading the category’s explosive growth. Both brands saw their volume share of global RTDs almost double between 2019 and 2020. However, there are signs US hard seltzer performance is rapidly deteriorating.

Broad portfolios of leading brewers reflects the local nature of beer

Leading international brewers AB InBev, Heineken and Carlsberg have broad brand portfolios with a number of smaller brands that together make a significant contribution to overall sales.

Others, such as China Resources, make the top 10 rankings globally through just a handful of brands focused generally on a limited number of key markets.

This all reflects the nature of the beer industry - the majority of brands tend to be local in focus and it is the internationally popular options that are the exceptions.

Asahi’s recent acquisitions and expansion efforts are apparent in the gradually declining share of its top brands.

Limited pandemic-driven gains for private label

Private label has struggled to make much headway in alcoholic drinks, where it competes against the considerable strength of established brands. This remained true in 2020, with just statistically insignificant volatility. Wine leads private label sales, greatly aided by the relative weakness of branded products compared to beer or spirits.

The financial impacts of the pandemic to date have been unequally distributed - a disparity that will be reflected in the nature and timing of recovery. As the longer-term economic effects start to become apparent, the pattern of premiumisation is expected to be replaced by polarisation, with growth at the highest and lowest ends of the spectrum.

In such an environment, economy brands are likely to see their popularity rise. In specific markets where the distribution landscape allows, private label could benefit from this. However, overall share is expected to remain fairly limited, as competition from value-focused branded offers remains high.

Sustainability is gradually climbing the agenda

Sustainability has played a less visible role in shaping purchasing decisions in alcoholic drinks than in many other industries.

Nevertheless, virtually all leading alcoholic drinks players have been stepping up their efforts in this area with varying levels of ambition evident in targets. Sustainability reports have been integrated into main annual reports as interest in non-financial measures of performance increases.

Part of the reason for improving efficiency and environmentally-friendly practices is necessity. However, there is also a growing expectation from consumers that companies will demonstrate environmental and social responsibility. This was enhanced as priorities were reassessed during the pandemic.

Efforts need to be genuinely effective and reflected in companies’ wider attitudes and values. The result otherwise may be negative impacts on brand perceptions, as illustrated by the backlash against BrewDog following criticism of company culture by previous employees in mid-2021.

All eyes are on the on-trade

The nature of the on-trade recovery will be a key factor governing company performance in the near future.

On-trade impacts were not uniform across the industry; nightclubs and similar high-energy occasions have been particularly hard hit. Brands and categories that are particularly exposed to these channels have faced greater challenges and the need for creative solutions in efforts to shift to at-home occasions. In early 2020, Jägermeister launched its international “Save the Night” campaign, supporting bartenders, musicians and artists. One initiative, the “Meister Drop-Ins”, allowed consumers to book entertainment for their own virtual parties during lockdowns, helping to replace lost income for those involved.

While many of the factors influencing on-trade progress are outside companies’ control, there are steps being taken to support recovery. In June 2020, Diageo announced a 2-year, USD100 million hospitality support programme, focused on key global cities including New York, London, Shanghai and Nairobi. Numerous other local or national initiatives have also been launched, such as Heineken’s EUR10 million package for pubs and hotels in Ireland.

There are already signs the expected boost from pent-up demand is starting to materialise following re-opening in a number of markets, although there is still the potential for further disruption. The on-trade return will help to fuel short- to mid-term recovery in the industry. The hospitality sector still remains vital to innovation, promotion and product launches (particularly for spirits), although alternative digital approaches are on the rise.