PACRIM'S SUMMARY FOR CRAFT BEER IN THAILAND

KEY DATA FINDINGS

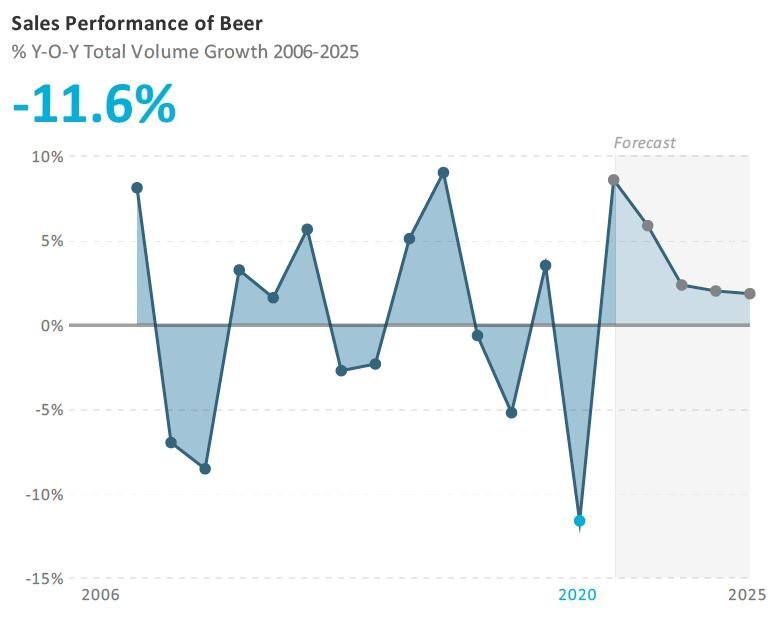

The onset of COVID-19 leads to a strong fall in on-trade volume sales of beer in 2020, due to a temporary ban on sales of alcohol, the closure of entertainment venues and the loss of tourists, with off-trade sales also experiencing a contraction

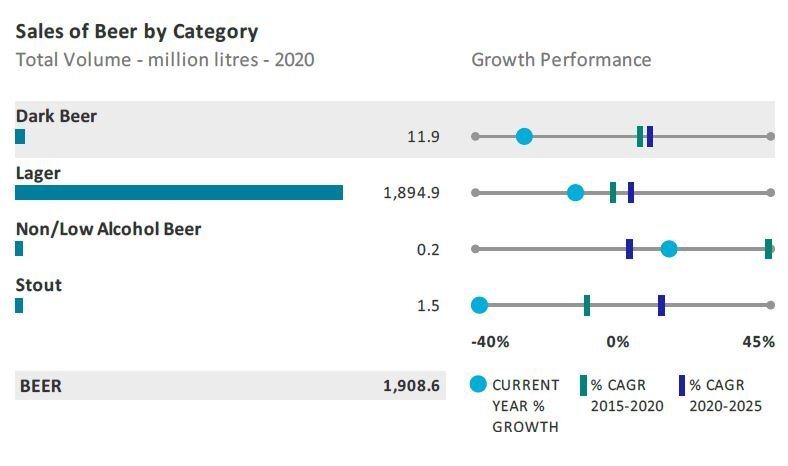

Beer sees total volume contraction of 12% in 2020 to reach 1,908 million litres

Non/low alcohol beer achieves the highest total volume growth of 16% in 2020, to reach 200,000 litres

Unit prices of beer rise by 3% in 2020

Boon Rawd Brewery remains the outright leading player in beer in 2020 with a total volume share of 59%

In the forecast period, beer is expected to see a total volume CAGR of 4%, to reach 2,329 million litres in 2025

Canadian Craft Beer Thailand Forecast 2022.JPG

2020 IMPACT

Significant decline in vo lume sales in the on trade while the off trade also contracts as businesses close, consumers are in lockdown and tourism is decimated

On-trade sales of beer experienced a strong negative impact from COVID-19 in 2020, whilst the off-trade also witnessed a decline. This was partly due to a nationwide ban on all sales of alcohol from early April, which was extended until the beginning of May for the off-trade channel and for take-away alcoholic drinks, although the ban lasted longer for dine-in customers. Despite stockpiling when the off-trade ban ended, total volume sales of beer continued to decline. Meanwhile, the closure of on-trade establishments such as restaurants, bars and nightclubs in the first quarter of 2020 also strongly negatively impacted on-trade sales of beer, with some increase in consumption in the home as a result. However, as the consumption of alcoholic drinks on-trade is often for social occasions, not all of the lost on-trade volumes shifted to the off-trade, especially as gatherings at home, such as parties, had also been banned to prevent the spread of the virus. In addition, some of the lost on-trade consumption shifted towards off-trade consumption of soft drinks such as bottled water and carbonates, rather than beer. Although from the beginning of May restaurants were gradually allowed to reopen, bars and nightclubs were not allowed to resume trading until 1 July. Meanwhile, those that had been able to afford to reopen had to implement social distancing measures, limiting customer footfall, with consumers’ reluctance to get back to their previous social behaviour also hampering growth.

The Thai New Year, Songkran, is usually in April, but in 2020 the government chose to cancel the celebrations in order to minimise the threat of infection and avoid large gatherings. The cancellation of this festival also had a significant impact on sales of beer. The ongoing presence of the virus meant year-end celebrations were also muted with consumers inclined to stay at home. The cancellation of international sports events such as the Tokyo Olympic Games and the European Football Championship also negatively affected sales of beer in 2020.

Included among government measures to prevent the spread of COVID-19 was the closure of the country’s borders, with certain exceptions. This decimated tourism, which also had a negative impact on beer sales, as tourists generally account for a large share of beer sales, particularly via the on-trade channel.

There were few problems with the supply of beer to the off-trade during 2020. As most beer by volume is produced domestically by major players such as Thai Beverage and Boon Rawd Brewery, the supply chain was short with players attaining control. As such, distribution was assured. However, due to the ongoing restrictions on the advertising of alcoholic drinks, companies were not allowed to carry out any advertising campaigns. Thus, the only tools they were able to use were pricing strategies via offline channels. However, in order to raise awareness during COVID-19, beer companies did carry out CSR activities. For instance, Thai Beverage donated a huge volume of alcohol gel to hospitals for five months, while Boon Rawd Brewery provided THB50 million to support hospitals.

In terms of the off-trade, most sales occurred via modern grocery retailers, although the lockdown did boost the share growth of e-commerce in the first half of the year, as consumers avoided leaving their homes where possible. However, from the second half of 2020 the government implemented a ban on sales of alcoholic drinks online, which meant the share of e-commerce for the entire year remained low.

Craft Beer Growth in Thailand 2021.JPG

The closure of the on-trade leads to A switch out of the category, often to other spirits

During 2020, COVID-19 government restrictions around the on-trade led to a significant shift in volume sales to the off-trade channel. In addition to the closure and imposition of curfews and other than during the 3-week alcohol ban in April to early May, most beer consumers preferred to keep themselves safe and opted to drink at home. However, among those who generally prefer to drink in bars and pubs, sales fell away entirely leading to an overall dramatic fall in total volume sales for the year. A shift from beer to cheap other spirits such as Surakhao was also evident among some value-conscious consumers seeking to obtain the highest ABV for their money.

Alcohol ban and other restrictions provide strong boost for non/low alcohol beer

Non/low alcohol beer benefited from the pandemic and consumer switches away from beer as it was the only beer product permitted during lockdown in April to early May. Given this ban and many other constraints around beer consumption during the height of the pandemic in 2020, consumers tended to embrace this alternative to a much greater degree than they did before the onset of COVID-19. For instance, although sales remained negligible in 2019, non/low alcohol beer was starting to enjoy rapid growth in the country, primarily as a result of the ongoing health and wellness trend. Whilst Bavaria 0.0% was one of the first brands to be introduced in this category, it was followed by the launch of Heineken 0.0, as Thai Asia Pacific Brewery sought to tap into the rising consumer demand for healthier products. This category is also likely to benefit from the potential for stiffer penalties for drink drivers over the forecast period which were under discussion prior to the pandemic.

Beer Category Growth in Thailand 2021.JPG

RECOVERY AND OPPORTUNITIES

Boost for local players and their lower prices due pandemic-induced financial constraints

The pandemic created opportunities for domestic beer brands such as Chang and Singha with their local presence enabling them to maintain a good supply line. This is set to stand them in good stead over the forecast period as are their cheaper prices as the economic consequences of the pandemic are set to reduce disposable income, leading to a preference for more economy priced beer brands. Therefore, during the forecast period, local players in beer are expected to benefit from higher demand.

On-trade brands and beer categories take longer to recover than their off-trade counterparts

Beer categories that are mainly sold via the on-trade are expected to take longer to recover than those sold via the off-trade. For instance, craft beer suffered heavily in 2020 as it is mostly old in on-trade premises such as bars and restaurants, in which consumption was greatly affected by closures, a temporary ban on the sale of alcohol and the imposition of social distancing measures. Furthermore, weak consumer sentiment and lower disposable incomes due to the impact of COVID-19 on the country’s economy may also contribute towards a downtrading away from craft beer, which is priced at higher levels than most lager. The same downtrading trend is expected to hamper sales of premium lager, with imported premium lager particularly suffering from the closure of countries’ borders. Meanwhile, economy lager is expected to bounce back strongly thanks to the wide availability of such products and their lower prices.

Sales fade for low/non-alcohol beer while on-trade sales of wheat beer, stout and premium imported beer hindered by ongoing drop in tourism

Low/non-alcohol beer benefited from being permitted for sale during the lockdown when sales of alcoholic beverages were banned with retailers’ alcoholic drinks shelves being filled with Heineken 0.0 instead, which can be seen as a substitute. However, despite the growth of these products in 2020 and their subsequent stronger appeal among a wider audience, their sales are expected to remain negligible over the forecast period. As such, the performance of low/nonalcohol beer is unlikely to have a considerable impact on the overall beer category going forward. As lifestyles gradually return to normal when the pandemic comes under control, consumers are likely to switch back from low/non-alcohol beer to regular products. This is because Thai consumers will continue to prefer regular beer that contains alcohol than beer that only offers the taste of regular beer. Thus, when all government restrictions come to an end, demand for beer with an alcohol content is expected to return.

However, wheat beer, stout and premium-imported beer are expected to take time to recover from the pandemic as such products will continue to be hampered by the anticipated longerrecovery period of the tourism industry, with tourist numbers unlikely to reach pre-pandemic levels for some time.