Downsizing: A Solution for Premium Brands in the Covid-19 Era

Here at PACRIM we’re taking a hard look at Latin America as a business unit, particularly amidst the Covid-19 pandemic – the region is exhibiting significant consolidation and growth in key segments which we find particularly alluring.

According to Euromonitor, social distancing measures could persist for roughly two to four quarters. Therefore, it remains possible that almost a year of bar and restaurant sales may be lost, withstanding any considerations of a second outbreak.

As such, categories, whose primary introduction to consumers is through on trade establishments, will struggle. Gin and liqueurs, commonly prepared for bar cocktails, will need to push greater at home consumption, particularly among middle and higher income consumers.

On the one hand, some higher end consumers will be inclined to educate themselves on cocktails as has been seen to a greater degree in other markets. However, generally the proportion of these consumers is much smaller.

Therefore, consumers will gravitate towards mixed drinks in the home that are widely available such as rum and Coke, gin and tonic, and margaritas in the case of Mexico. This lack of mixology culture may give rise to the consumption of RTD products and the trend is already manifesting itself with the entrance of disrupting brands such as Coca Cola’s Topo Chico Hard Seltzer, which will likely lead a wave of innovation within this category over the forecast period.

The experience of quarantine has been varied across the region. Some countries such as Chile and a few Central American countries imposed strict lockdowns or curfews to limit the spread of the virus. Some countries such as Mexico and Brazil have promoted staying at home without an executive order.

In most cases, certain drinking occasions were born of isolation, for categories such as beer and wine. Spirits experienced difficulty in migrating because of their emphasis on premium branding and social occasions.

Both drivers are suppressed and as a result, in the months following the pandemic, many brands will feel pressure to reduce prices in order to compete for a shrinking consumer base. For certain brands, particularly premium and super premium, this strategy may backfire as consumers migrate to driving their purchases based on bargains rather than brand loyalty. Premium brands should instead focus on providing an experience at home for consumers who find themselves bored.

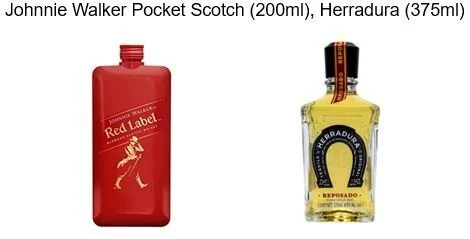

Launching smaller formats of spirits brands is one method of maintaining consumer interest and competitiveness. Some consumers in isolation have been turning to new hobbies, one of which has been mixology.

Lost on-premise occasions can be converted to the home in order to regenerate interest in a particular spirit or brand. Particularly middle-class consumers could stand to gain from smaller format offerings, as that makes normally out of range products accessible for crafting quality mixed drinks. These consumers were also more likely than lower-class consumers pre-COVID-19 to express curiosity in new drinks in bars and restaurants.

With all this said, we believe smaller formats, at lower, more accessible price points makes sense for spirits, but also translates proportionally to craft beer as well. Entry with 355ml and 230ml sleek can formats with brands that cut through the clutter is certainly one way to kick the Covid hangover.

Canadian craft spirits export.JPG